Wood Products Incorporated manufactures plywood in two processing departments, Milling and Sanding, and uses the weighted average

Question:

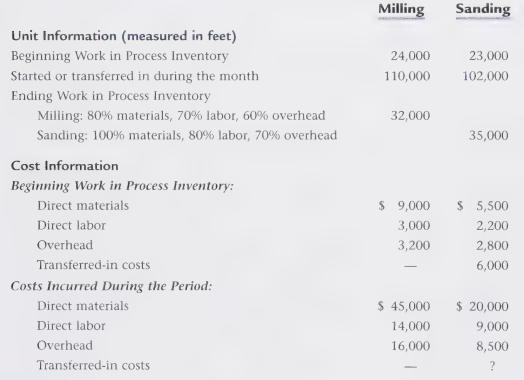

Wood Products Incorporated manufactures plywood in two processing departments, Milling and Sanding, and uses the weighted average method for its process costing system. The information that follows is for the month of April.

Required

a. Prepare a production cost report for the Milling Department for the month of April. Confirm that total costs to be accounted for (from step 2) equals total costs accounted for (from step 4); minor differences may occur due to rounding the cost per equivalent unit in step 3.

b. Prepare a production cost report for the Sanding Department for the month of April. The current period transferred-in cost amount comes from the production cost report prepared for the Milling Department in requirement a.

Confirm that total costs to be accounted for (from step 2) equals total costs accounted for (from step 4); minor differences may occur due to rounding the cost per equivalent unit in step 3.

c. For the Milling Department, prepare journal entries to record:

(1) The cost of direct materials placed into production during the month (from step 2).

(2) Direct labor costs incurred during the month but not yet paid (from step 2).

(3) The application of overhead costs during the month (from step 2).

(4) The transfer of costs from the Milling Department to the Sanding Department (from step 4).

d. For the Sanding Department at Wood Products Incorporated, prepare journal entries to record:

(1) The cost of direct materials placed into production during the month (from step 2).

(2) Direct labor costs incurred during the month but not yet paid (from step 2).

(3) The application of overhead costs during the month (from step 2).

(4) The transfer of costs from the Sanding Department to the finished goods warehouse (from step 4).

e. Set up the following T accounts: WIP Inventory—Milling, WIP Inventory—Sanding, and Finished Goods Inventory. Summarize the flow of costs through these T accounts and calculate the ending balance for each account. Assume Finished Goods Inventory has no beginning balance. Both WIP Inventory accounts have beginning balances as shown on the production cost report.

Step by Step Answer: