4. What is the increase in R when you compare the fitted cubic with the fitted qua-...

Question:

4. What is the increase in R when you compare the fitted cubic with the fitted qua- dratic model? Is the fitted cubic model significantly better than the fitted quadratic? Are there any patterns in a plot of the residuals versus x? What proportion of the variation in the response Y is not accounted for by fitting a cubic model? Should any higher-order polynomial model be considered? Why or why not?

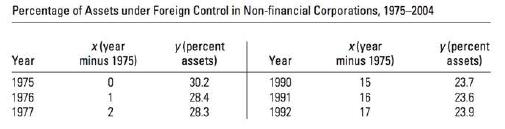

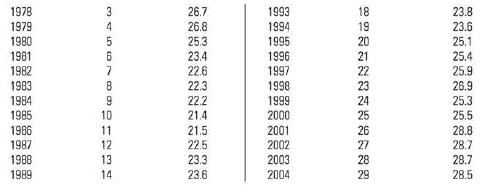

The case study in Chapter 12 examined the effects of government regulation on for- eign ownership of assets in Canada. For example, the Foreign Investment Review Agency was created in 1975 to monitor and regulate foreign takeovers in Canada. In 1985, after a change of government, the Foreign Investment Review Agency was replaced with a new agency, Investment Canada, whose mandate was intended to be less restrictive. Did this change have any effect? The data in the table represent the percentage of commercial assets in non-financial corporations under foreign control (y) for the years 1975-2004. To simplify the analysis, we have coded the year using the coded variable x = year 1975. By examining a scatterplot of the data, you will find that the percentage of foreign ownership of Canadian assets does not appear to follow a linear relationship over time, but rather exhibits a curvilinear response. The question, then, is to decide whether a second-, third-, or higher-order model adequately describes the data."

Step by Step Answer:

Introduction To Probability And Statistics

ISBN: 9780176509804

3rd Edition

Authors: William Mendenhall