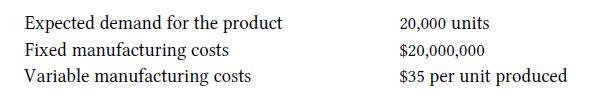

Assume the James Corp. makes engine parts for cars. Some selected cost information is shown below: A.

Question:

Assume the James Corp. makes engine parts for cars. Some selected cost information is shown below:

A. Assume the company makes and sells the 20,000 units it expects to make and sell. No items are left in inventory.

a. What are the total variable costs?.

b. What are the total fixed manufacturing costs?

c. What were the fixed manufacturing costs per unit produced?

d. What is the cost of goods sold? (Hint—all the items produced were sold.)

e. What is the average cost per unit of the items sold?

B. Assume the company produces 40,000 units, but only sells 20,000. It has 20,000 units left in inventory.

a. What are the total variable costs?

b. What are the total fixed manufacturing costs?

c. What were the fixed manufacturing costs per unit produced?

d. Assuming the company uses the same cost per unit to value its ending inventory as it does to value the units it sold, what is the cost of the 20,000 units sold?

e. What is the cost of the 20,000 units remaining in inventory?

C. Compare your answers to parts A and B above.

a. Does the company show higher income when it produces 20,000 units or 40,000?

b. Explain why the difference in reported income in parts A and B could lead to dysfunctional behavior for companies.

Step by Step Answer:

Introductory Accounting A Measurement Approach For Managers

ISBN: 9781138956216

1st Edition

Authors: Daniel P. Tinkelman