(Bank leverage example and fair value) This is a simplified example. The actual regulations for banks are...

Question:

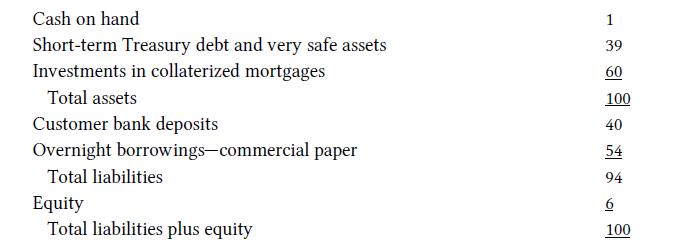

(Bank leverage example and fair value) This is a simplified example. The actual regulations for banks are more complex.39 Assume that regulators require banks to have equity equal to 5% or more of their total assets. Assume the Barney Bank has the following summarized balance sheet:

A. Does the bank meet the regulatory requirement with regard to the minimum amount of equity on hand?

B. Assume that the market value for securitized mortgages suddenly drops by 5%, and the value of the mortgages owned by the bank falls from 60 to 57.

a. What would be the total assets?

b. What would be the equity?

c. Would the bank still meet the regulatory requirement for the minimum ratio of equity to total assets?

C. Some ways that a bank can increase its ratio of equity to assets are listed below. Comment on which you think may be seen as beneficial to the current shareholders, and which are likely not to be welcome to the bank?

a. Selling off assets and using the money to pay off liabilities

b. Selling new stock in the bank, at the price that the company can get at this time

c. Revalue other assets to a higher value, thus increasing reported assets.

Step by Step Answer:

Introductory Accounting A Measurement Approach For Managers

ISBN: 9781138956216

1st Edition

Authors: Daniel P. Tinkelman