(Inventory cost methodsrapid inflation) Assume the Royal Gas Corp. buys gasoline from a refinery, and sells it...

Question:

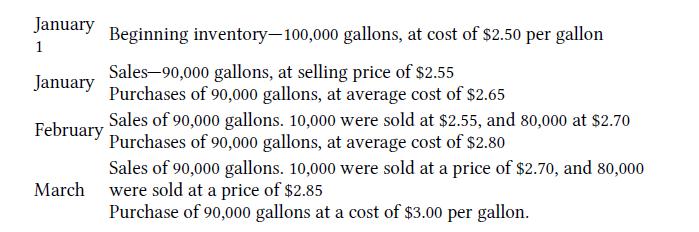

(Inventory cost methods—rapid inflation) Assume the Royal Gas Corp. buys gasoline from a refinery, and sells it to local gas companies. It follows a policy of always selling its gasoline for 5 cents per gallon more than it paid, using a first in, first out (FIFO) assumption. Its records show the following with regard to its inventory:

A. Using FIFO, compute the cost of goods sold, and the cost of the ending inventory of 100,000 gallons.

B. What was the total revenue?

C. What was the profit for the three months, on a FIFO basis? (Hint—it should equal 5 cents per gallon.)

D. If the company computed its cost of goods sold on a LIFO basis, with the assumption that all sales in a month occurred after the purchases in each month, compute the cost of goods sold, and the net profit or loss for the three months.

E. What did the company spend in cash on its total purchases for the period?

F. How much did cash increase or decrease during the period, assuming all revenues were in cash?

G. If you were running the business, do you think you would find the LIFO or the FIFO computations of profits more useful for decisionmaking?

Explain your answer.

Step by Step Answer:

Introductory Accounting A Measurement Approach For Managers

ISBN: 9781138956216

1st Edition

Authors: Daniel P. Tinkelman