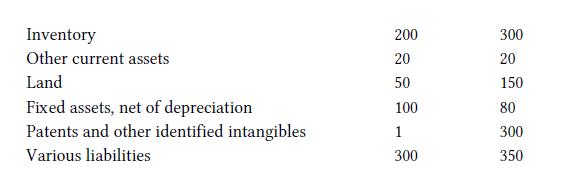

The Benning Corp. buys Dix Corp. for a total purchase price of $1 billion. Shown below are

Question:

The Benning Corp.

buys Dix Corp. for a total purchase price of $1 billion. Shown below are the values of the various assets and liabilities of Dix as of the date of the purchase, in millions of dollars, on the books of Dix as well as their estimated fair value.

A. Compute the goodwill that Benning will record after this purchase.

B. Explain the likely reason why there would be large differences between the book value and the fair value of the following items as of the date of the acquisition:

a. Inventory

b. Land

c. Fixed assets, net of depreciation

d. Patents and other identified intangible assets C. When the inventory is sold in the next year, what will the company record as cost of goods sold, 200 or 300?

D. When the patents are amortized in the future, will amortization be based on $1 or on $300?

E. Is goodwill amortized under normal GAAP?

F. In general, would future reported income be higher if the estimates of the values of the various assets acquired are high, leading to low goodwill, or low, leading to a high value assigned to goodwill? Explain your answer.

Step by Step Answer:

Introductory Accounting A Measurement Approach For Managers

ISBN: 9781138956216

1st Edition

Authors: Daniel P. Tinkelman