Financial analysts often debate the role of dividends ((D V)) in the determination of share prices ((S

Question:

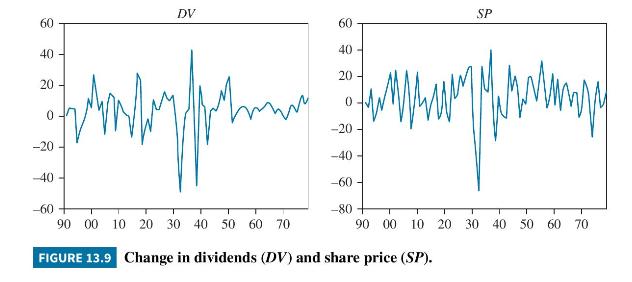

Financial analysts often debate the role of dividends \((D V)\) in the determination of share prices \((S P)\). Figure 13.9 shows plots of the rate of change in \(D V\) and \(S P\) computed as

where \(P N\) is the Standard and Poor Composite Price Index; \(D N\) is the nominal dividend per share (source: Prescott, E. C. and Mehra, R. "The Equity Premium: A Puzzle," Journal of Monetary Economics, 15 March, 1985, pp. 145-161). The data are annual observations over the period 1889-1979.

The data file is called equity. Estimate a first-order VAR for \(S P\) and \(D V\) by applying least squares to each equation:

\[

\begin{gathered}

S P_{t}=\beta_{10}+\beta_{11} S P_{t-1}+\beta_{12} D V_{t-1}+v_{t}^{s} \\

D V_{t}=\beta_{20}+\beta_{21} S P_{t-1}+\beta_{22} D V_{t-1}+v_{t}^{d}

\end{gathered}

\]

Estimate an ARDL for each equation:

\[

\begin{gathered}

S P_{t}=\alpha_{10}+\alpha_{11} S P_{t-1}+\alpha_{12} D V_{t-1}+\alpha_{13} D V_{t}+e_{t}^{s} \\

D V_{t}=\alpha_{20}+\alpha_{21} S P_{t-1}+\alpha_{22} D V_{t-1}+\alpha_{23} S P_{t}+e_{t}^{d}

\end{gathered}

\]

Compare the two sets of results and note the importance of the contemporaneous endogenous variable \((S P, D V)\) in each equation.

a. Explain why least squares estimation of the VAR model with lagged variables on the right-hand side yields consistent estimates.

b. Explain why least squares estimation of the model with lagged and contemporaneous variables on the right-hand side yields inconsistent estimates.

c. What do you infer about the role of dividends in the determination of share prices?

Step by Step Answer:

Principles Of Econometrics

ISBN: 9781118452271

5th Edition

Authors: R Carter Hill, William E Griffiths, Guay C Lim