The data file malawi_small contains survey data from Malawi during 2007-2008 on total household expenditures in the

Question:

The data file malawi_small contains survey data from Malawi during 2007-2008 on total household expenditures in the prior month (in Malawian Kwacha) as well as expenditures on categories of goods such as food, clothes, and fuel.

a. Locate Malawi and its neighboring countries on a map. Find the exchange rate between US \(\$ 1\) and the Malawian Kwacha. What is the population size of Malawi? Which industry drives the Malawi economy?

b. Define the proportion of expenditure on food as \(P F O O D=F O O D / T O T E X P\). Estimate the linear-log regression model PFOOD \(=\beta_{1}+\beta_{2} \ln (\) TOTEXP \()+e\) and report the estimation results. What happens to the share of total expenditure devoted to food as total expenditure rises. Construct a \(95 \%\) interval estimate for \(\beta_{2}\). Have we estimated this coefficient relatively precisely or not? Does the model fit the data well? Is there a problem?

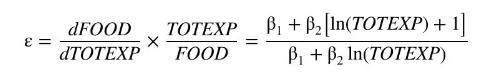

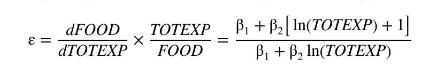

c. The elasticity of expenditure on food with respect to total expenditure is

This result is derived in Exercise 4.12. Calculate the elasticity at the 5th percentile and the 75th percentile of total expenditure. Is this a constant elasticity function? If your software permits, calculate a standard error for the elasticity.

d. Calculate the least squares residuals from the model in (b). Construct a histogram of these residuals and plot them against \(\ln (T O T E X P)\). Are any patterns evident? Find the sample skewness and kurtosis of the least squares residuals. Carry out the Jarque-Bera test at the \(1 \%\) level of significance. What are the null and alternative hypotheses for this test?

e. Take the logarithm of the left-hand side of FOOD/TOTEXP \(=\beta_{1}+\beta_{2} \ln (\) TOTEXP \()\) and simplify the result, and add an error term, to obtain \(\ln (F O O D)=\alpha_{1}+\alpha_{2} \ln (T O T E X P)+v\). Estimate this model. Interpret the estimated coefficient of \(\ln (T O T E X P)\). What is the estimated elasticity of expenditure on food with respect to total expenditure?

f. Calculate the residuals from the model in (e). Construct a histogram of these residuals and plot them against \(\ln (\) TOTEXP \()\). Are any patterns evident? Find the sample skewness and kurtosis of the least squares residuals. Carry out the Jarque-Bera test at the \(1 \%\) level of significance.

g. Estimate the linear-log model FOOD \(=\gamma_{1}+\gamma_{2} \ln (T O T E X P)+u\). Discuss the estimation results. Calculate the elasticity of food expenditure with respect to total expenditure when food expenditure is at its 50th percentile and at its 75 th percentile. Is this a constant elasticity function, or is elasticity increasing or decreasing?

h. Calculate the residuals from the model in (g). Construct a histogram of these residuals and plot them against \(\ln (T O T E X P)\). Are any patterns evident? Find the sample skewness and kurtosis of the least squares residuals. Carry out the Jarque-Bera test at the \(1 \%\) level of significance.

i. Calculate predicted values of expenditure on food from each model. Multiply the fitted value from the model in part (b) to obtain a prediction for expenditure on food. Using the model in part (e) obtain \(\exp [\widehat{\ln (F O O D)}]\). For the model in part (g), obtain fitted values. Find the correlations between the actual value of FOOD and the three sets of predictions. What, if any, information is provided by these correlations? Which model would you select for reporting, if you had to choose only one? Explain your choice.

Data From Exercise 4.12:-

Consider the share of total household expenditure (TOTEXP) devoted to expenditure on food (FOOD). Specify the log-linear relationship FOOD/TOTEXP \(=\beta_{1}+\beta_{2} \ln (\) TOTEXP \()\).

a. Show that the elasticity of expenditure on food with respect to total expenditure is

b. The least squares estimates of the regression model FOOD/TOTEXP \(=\beta_{1}+\beta_{2} \ln (\) TOTEXP \()+e\), using 925 observations from London, are as follows:

Interpret the estimated coefficient of \(\ln (T O T E X P)\). What happens to the share of food expenditure in the budget as total household expenditures increase?

c. Calculate the elasticity in part (a) at the 5th percentile, and the 75th percentile of total expenditure. Is this a constant elasticity function? The 5th percentile is \(500 \mathrm{UK}\) pounds, and the 75th percentile is 1200 UK pounds.

d. The residuals from the model in (b) have skewness 0.0232 and kurtosis 3.4042. Carry out the Jarque-Bera test at the \(1 \%\) level of significance. What are the null and alternative hypotheses for this test?

e. In FOOD/TOTEXP \(=\beta_{1}+\beta_{2} \ln (\) TOTEXP \()\), take the logarithm of the left-hand side and simplify the result to obtain \(\ln (F O O D)=\alpha_{1}+\alpha_{2} \ln (T O T E X P)\). How are the parameters in this model related to the budget share relation?

f. The least squares estimates of \(\ln (F O O D)=\alpha_{1}+\alpha_{2} \ln (\) TOTEXP \()+e\) are as follows:

Interpret the estimated coefficient of \(\ln (T O T E X P)\). Calculate the elasticity in this model at the 5 th percentile and the 75th percentile of total expenditure. Is this a constant elasticity function?

g. The residuals from the log-log model in (e) show skewness \(=-0.887\) and kurtosis \(=5.023\). Carry out the Jarque-Bera test at the \(5 \%\) level of significance.

h. In addition to the information in the previous parts, we multiply the fitted value in part (b) by TOTEXP to obtain a prediction for expenditure on food. The correlation between this value and actual food expenditure is 0.641. Using the model in part (e) we obtain \(\exp [\widehat{\ln (F O O D)}]\). The correlation between this value and actual expenditure on food is 0.640. What if any information is provided by these correlations? Which model would you select for reporting, if you had to choose only one? Explain your choice. only one? Explain your choice.

Step by Step Answer:

Principles Of Econometrics

ISBN: 9781118452271

5th Edition

Authors: R Carter Hill, William E Griffiths, Guay C Lim