ABC Hardware Company began 20x4 with 60,000 units of inventory that cost 36,000. During 20x4, ABC purchased

Question:

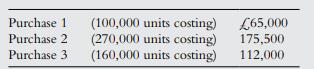

ABC Hardware Company began 20x4 with 60,000 units of inventory that cost £36,000. During 20x4, ABC purchased goods on credit for £352,500 as follows:

Cash payments to suppliers totalled £330,000 during the year.

ABC’s sales during 20x4 consisted of 520,000 units of inventory for £660,000, all on credit. The company uses the FIFO inventory valuation method.

Cash collections from customers were £650,000. Operating expenses totalled £240,500, of which ABC paid £211,000 in cash by the end of the accounting year. As of 31 December, ABC had accrued income tax expense at the rate of 35% of income before tax.

Requie 1. Make summary journal entries to record ABC hardware’s transactions for the year, assuming the company uses a perpetual inventory system.

2. Determine the FIFO cost of ABC’s closing inventory as of 31 December 20x4 in two ways:

a. Using a T-account.

b. Multiplying the number of units on hand by the unit cost.

3. Show how ABC would compute the cost of goods sold for 20x4.

4. Prepare ABC Hardware’s SPL for 20x4, including the calculation of the tax for the period.

Step by Step Answer: