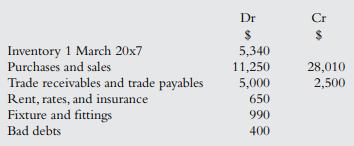

Elisabeth and Philip are in partnership, sharing profits and losses in the ratio 2:1. The following trial

Question:

Elisabeth and Philip are in partnership, sharing profits and losses in the ratio 2:1.

The following trial balance was prepared as of 28 February 20x8:

The following matters relate to the partnership accounts:

a. No interest is to be allowed on capital accounts.

b. Philip is entitled to a partnership salary of $5,290, but no entries have been made regarding this.

c. The partners’ capital accounts are to remain fixed at the figures shown in the trial balance. All other transactions concerning partners are to be made in the partners’ current accounts.

d. Inventory as of 28 February 20x8 is $4,340.

e. Amount of $200 for wages and salaries accrued as of 28 February 20x8.

f. No allowance/provision is to be made for depreciation.

g. Amount of $50 for rates prepaid on 28 February 20x8.

Requie:

1. A profit and loss and appropriation account for the year ended 28 February 20x8.

2. An SFP as of 28 February 20x8.

Step by Step Answer: