The House of Frazer Department Stores Ltd operates a number of department stores in the United Kingdom.

Question:

The House of Frazer Department Stores Ltd operates a number of department stores in the United Kingdom. Let’s assume that the company’s accounting year ends each 31 January.

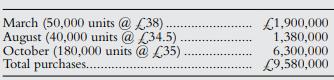

The store in London had an opening inventory in year 20x1 of 55,000 units that cost £1,650,000. During the year, the store purchased goods on credit as follows:

Cash payments on credit during the year totalled £9,110,000.

During fiscal year 20x1, the store sold 285,000 units of merchandise for £14,000,000, of which £4,100,000 was in cash and the remaining was on account (credit).

Assume that House of Frazer uses the LIFO inventory valuation method.

Operating expenses for the year were £3,180,000. House of Frazer paid two-thirds in cash and accrued the rest. The store accrued income tax at the rate of 32%.

Requie 1. Make summary journal entries to record the store’s transactions for the year ended 31 January 20x1. House of Frazer uses a perpetual inventory system to record inventories.

2. Determine the closing inventory based on the LIFO inventory valuation method using a T-account.

3. Prepare the store’s SPL for the year ended 31 January 20x1.

Step by Step Answer: