A partial amortization schedule for a five-year note payable that Mercury Co. issued on January 1, Year

Question:

A partial amortization schedule for a five-year note payable that Mercury Co. issued on January 1, Year 1, is shown next:

Required

a. What rate of interest is Mercury Co. paying on the note?

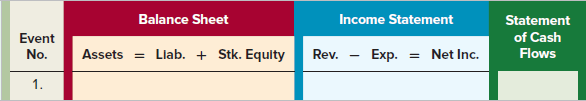

b. Using a financial statements model like the one shown next, record the appropriate amounts for the following two events:

(1) January 1, Year 1, issue of the note payable

(2) December 31, Year 2, payment on the note payable

c. If the company earned $75,000 cash revenue and paid $32,000 in cash expenses in addition to the interest in Year 1, what is the amount of each of the following?

(1) Net income for Year 1

(2) Cash flow from operating activities for Year 1

(3) Cash flow from financing activities for Year 1

d. What is the amount of interest expense on this loan for Year 3?

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds