Ball Company was started in Year 1. The following summarizes transactions that occurred during Year 1: 1.

Question:

Ball Company was started in Year 1. The following summarizes transactions that occurred during Year 1:

1. Issued a $40,000 face value discount note to Golden Savings Bank on April 1, Year 1. The note had a 6 percent discount rate and a one-year term to maturity.

2. Recognized revenue from services performed for cash, $130,000.

3. Incurred and paid $98,000 cash for selling and administrative expenses.

4. Amortized the discount on the note at the end of the year, December 31, Year 1.

The following summarizes transactions that occurred in Year 2:

1. Recognized $215,000 of service revenue in cash.

2. Incurred and paid $151,000 for selling and administrative expenses.

3. Amortized the remainder of the discount for Year 2 and paid the face value of the note.

Required

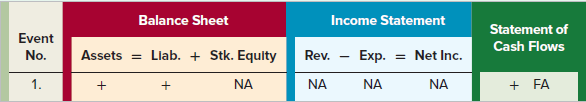

a. Show the effects of each of the transactions on the elements of the financial statements, using a horizontal statements model like the one shown next. Use + for increase, − for decrease, and NA for not affected. The first transaction is entered as an example.

b. Prepare an income statement, statement of changes in stockholders’ equity, balance sheet, and statement of cash flows for Year 1 and Year 2.

Discount RateDepending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal... Face Value

Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the...

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds