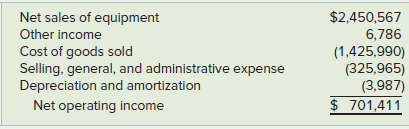

Bell Farm and Garden Equipment Co. reported the following information for Year 1: Selected information from the

Question:

Bell Farm and Garden Equipment Co. reported the following information for Year 1:

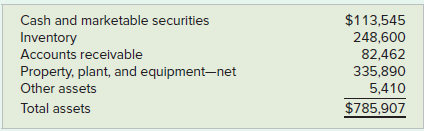

Selected information from the balance sheet as of December 31, Year 1, follows:

Assume that a major customer returned a large order to Bell on December 31, Year 1. The amount of the sale had been $146,800, with a cost of sales of $94,623. The return was recorded in the books on January 1, Year 2. The company president does not want to correct the books. He argues that it makes no difference as to whether the return is recorded in Year 1 or Year 2. Either way, the return has been duly recognized.

Required

a. Assume you are the CFO for Bell Farm and Garden Equipment Co. Write a memo to the president explaining how the failure to recognize the return on December 31, Year 1, could cause the financial statements to be misleading to investors and creditors. Explain how omitting the return from the customer would affect net income and the balance sheet.

b. Why might the president want to record the return on January 1, Year 2, instead of December 31, Year 1?

c. Would the failure to record the customer return violate the AICPA Code of Professional Conduct? If the president of the company refuses to correct the financial statements, what action should you take?

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer: