Consider the following financial statements for Benjamin Company. During 2019, management obtained additional bond financing to enlarge

Question:

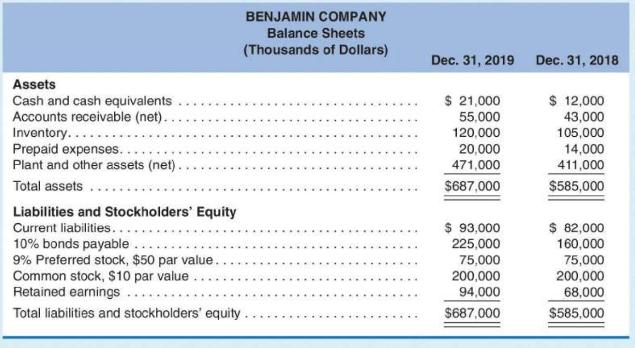

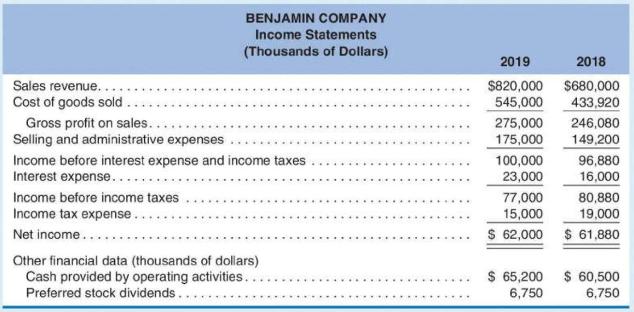

Consider the following financial statements for Benjamin Company.

During 2019, management obtained additional bond financing to enlarge its production facilities. The company faced higher production costs during the year for such things as fuel, materials, and freight. Because of temporary government price controls, a planned price increase on products was delayed several months.

As a holder of both common and preferred stock, you decide to analyze the financial statements:

Required

a. Calculate the following for each year: current ratio, quick ratio, operating-cash-flow-to-currentliabilities ratio (current liabilities were \(\$ 77,000,000\) at January 1,2018 ), inventory turnover (inventory was \(\$ 87,000,000\) at January 1,2018 ), debt-to-equity ratio, times-interest-earned ratio, return on assets (total assets were \(\$ 490,000,000\) at January 1, 2018), and return on common stockholders' equity (common stockholders' equity was \(\$ 235,000,000\) at January 1,2018 ).

b. Calculate common-size percentages for each year's income statement.

c. Comment on the results of your analysis.

Step by Step Answer: