Harden Co. issued a $60,000 face value discount note to National Bank on July 1, Year 1.

Question:

Harden Co. issued a $60,000 face value discount note to National Bank on July 1, Year 1. The note had a 6 percent discount rate and a one-year term to maturity.

Required

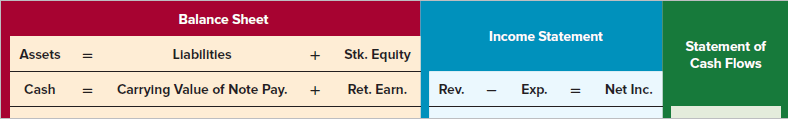

Show the effects of the following transactions (a–c) on the financial statements using a horizontal financial statement model such as that shown next. Record the transaction amounts under the appropriate categories. In the Statement of Cash Flows column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA).

a. The issuance of the note on July 1, Year 1.

b. The adjustment for accrued interest at the end of the year, December 31, Year 1.

c. Recording interest expense for Year 2 and repaying the principal on June 30, Year 2.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Discount Rate

Depending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal... Face Value

Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the...

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds