Kimberly Hills School System began the fiscal year July 1, XXXX, with the following account balances in

Question:

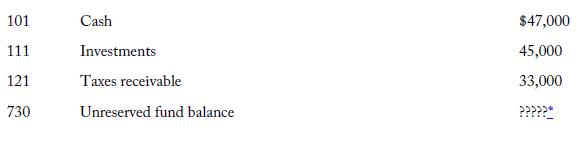

Kimberly Hills School System began the fiscal year July 1, XXXX, with the following account balances in the general fund:

To be computed by reader.

During the year that ended on June 30, XXXX (end of fiscal year), the following transactions were completed:

a. Local property taxes were assessed and levied in the amount of $150,000.

b. Received $200,000 in general state aid.

c. Paid salary of instructional staff of the special education program in the amount of $58,000.

d. Purchased equipment for the vocational home economics program in the amount of $35,000.

e. Paid instructional staff salaries in the amount of $15,000.

f. Collected $120,000 of the taxes that were previously assessed and levied.

g. Purchased and paid for general supplies in the amount of $35,000.

h. Paid salary of $15,000 for custodian.

i. General supplies were purchased on account in the amount of $6,000.

j. An amount of $65,000 was borrowed from the New Douglas State Bank against anticipated tax revenues.

Assume the chart of accounts for the school district consists of the following:

Assets (101, 111, 121)

Liabilities (421, 423)

Fund balance (730)

Revenue (1110, 3100)

Expenditures (object codes 110, 610, 733)

Instructions:

Record the beginning balances to the general ledger accounts.

Record the transactions to the general ledger accounts.

Prepare a trial balance as of June 30, XXXX (end of fiscal year).

Prepare a statement of revenues, expenditures and fund balance for the fiscal year.

Prepare a balance sheet as of June 30, XXXX (end of fiscal year).

Step by Step Answer:

Financial Accounting For School Administrators Tools For School

ISBN: 9781610487719

3rd Edition

Authors: Ronald E. Everett, Donald R. Johnson, Bernard W. Madden