On January 1, Year 1, Parker Company issued bonds with a face value of $80,000, a stated

Question:

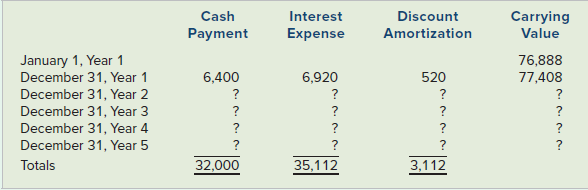

On January 1, Year 1, Parker Company issued bonds with a face value of $80,000, a stated rate of interest of 8 percent, and a five-year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 9 percent at the time the bonds were issued. The bonds sold for $76,888. Parker used the effective interest rate method to amortize the bond discount.

Required

a. Prepare an amortization table as shown next:

b. What item(s) in the table would appear on the Year 4 balance sheet?

c. What item(s) in the table would appear on the Year 4 income statement?

d. What item(s) in the table would appear on the Year 4 statement of cash flows?

Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the...

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds