The annual report for Target Corporation opens with a general description of business operations, risk factors, stock

Question:

The annual report for Target Corporation opens with a general description of business operations, risk factors, stock market registration, and selected financial data. This is followed by Management’s Discussion and Analysis of Financial Condition, in which management talks about financial results, including segment results, liquidity, and other matters deemed necessary to provide adequate disclosure to users of the report.

1. How many employees did Target have in 2016?

2. Identify at least five risk factors for Target.

3. On what stock market exchange is the company’s stock traded? What is Target’s symbol?

4. Who operates the pharmacies located in Target’s stores?

5. According to the Consolidated Statements of Operations, sales decreased from $73,785 million in 2015 to $69,495 million in 2016. Identify the main factor for this decline.

6. Target provides information about its capital expenditures related to three major categories: existing stores, new stores, and technology and supply chain. What percentage of capital expenditures were spent on each category in 2016 and in 2014? What has been the trend in Target’s capital expenditures over the past three years?

7. What is the name of the company’s independent auditors?

8. Who is responsible for the financial statements?

9. What is the outside auditors’ responsibility?

10. What type of opinion did the independent auditors issue on the financial statements (unqualified, qualified, adverse, or disclaimer)? What does this opinion mean?

11. The auditors’ report indicates the audit was concerned with material misstatements rather than absolute accuracy in the financial statements. What does “material” mean?

12. Using Excel, compute common-size income statements for all three fiscal years. In common- size income statements, net sales is 100 percent and every other number is a percentage of sales. Attach the spreadsheet to the end of this project.

13. Using the common-size income statements, identify the significant trends.

14. What was the gross margin (gross profit) and the gross margin percentage for fiscal years 2016, 2015, and 2014?

15. If the gross margin percentage changed over the three-year period, what caused the change?

16. What was the percentage return on sales for fiscal years 2016, 2015, and 2014? What do these ratios indicate about Target?

17. Using Excel, compute annual changes for each line item on the income statement. For each of the two most recent years, insert a column for changes in absolute dollars and insert another column for the percentage changes. Attach the spreadsheet to the end of this project.

18. What were the absolute dollar and the percentage changes in revenues between fiscal years 2016 and 2015 and between 2015 and 2014?

19. Describe the trend in revenues. Be specific (e.g., slight/steady/drastic increase or decrease each year, or fluctuating with an initial modest/significant increase or decrease followed by a modest/significant increase or decrease, etc.) to precisely describe the company’s situation.

20. What were the absolute dollar and the percentage changes in cost of sales (cost of goods sold) between fiscal years 2016 and 2015 and between 2015 and 2014?

21. Describe the trend in cost of sales (cost of goods sold). Be specific (e.g., slight/steady/ drastic increase or decrease each year, or fluctuating with an initial modest/significant increase or decrease followed by a modest/significant increase or decrease, etc.) to precisely describe the company’s situation.

22. What were the absolute dollar and the percentage changes in selling, general, and administrative expenses (operating expenses) between fiscal years 2016 and 2015 and between 2015 and 2014?

23. Describe the trend in selling, general, and administrative expenses. Be specific to precisely describe the company’s situation.

24. What were the absolute dollar and the percentage changes in net income between fiscal years 2015 to 2016 and 2014 to 2015?

25. How would you describe the trend for net income? Be specific to precisely describe the company’s situation. Do you expect the trend to continue?

26. Which items had the largest percentage change from 2014 through 2016, revenues or expenses?

27. Summarize what is causing the changes in net income from fiscal year 2014 to 2015 and 2015 to 2016 based on the percentages computed in Questions 18 through 26. Do you expect the trend to continue?

28. Using Excel, compute common-size balance sheets for the years ended January 28, 2017, and January 30, 2016. In common-size balance sheets, total assets is 100 percent and every other number is a percentage of total assets. Attach the spreadsheet to the end of this project.

29. Current assets constituted what percentage of total assets at January 28, 2017, and January 30, 2016? Which current asset had the largest balance at each fiscal year-end?

30. Long-term assets constituted what percentage of total assets at January 28, 2017, and January 30, 2016? Which long-term asset had the largest balance at each fiscal year-end?

31. Which category of assets (single line item) on the balance sheet is the largest as of January 28, 2016? Explain why a simple comparison of the percentage amounts for each asset line may lead to misleading results for answering the question, “Which category is largest?”

32. Current liabilities constituted what percentage of total assets at January 28, 2017, and January 30, 2016? Which long-term liability had the largest balance at each fiscal year-end?

33. Long-term liabilities constituted what percentage of total assets at January 28, 2017, and January 30, 2016? Which long-term liability had the largest balance at each fiscal year-end?

34. Calculate the ratio of stockholders’ equity to total assets on January 28, 2017, and January 30, 2016. Identify whether Target finances its assets mostly with debt or equity.

35. Using Excel, compute annual changes for each line item on the balance sheet. Insert a column for changes in absolute dollars and insert another column for the percentage changes. Attach the spreadsheet to the end of this project.

36. What was the absolute dollar and the percentage change between the January 30, 2016, and January 28, 2017, of “Assets of discontinued operations” in current assets, and “Non current assets of discontinued operations,” in long-term assets? Was the change an increase or decrease? What was the nature of the discontinued operations at Target? You will need to read the Notes to Consolidated Financial Statements to answer this.

37. What was the absolute dollar and the percentage change between the January 28, 2017, and January 30, 2016, balances for inventory? Was the change an increase or decrease? What line item (account) on the income statement is directly related to inventory? Did this account change in a similar direction as inventory?

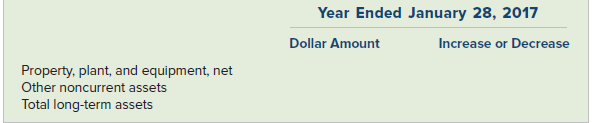

38. Compared to the January 30, 2016, balances, did the amounts reported for the following long-term assets increase or decrease? By how much? Include dollar amounts for each item.

What line item on the income statement is directly related to property, plant, and equipment? Did this account change in a similar direction as property, plant, and equipment?

39. What were the absolute dollar and the percentage changes of long-term liabilities from January 28, 2017, to January 30, 2016? Were the changes increases or decreases? What line item (account) on the income statement is closely related to the long-term liabilities? Did this account change in the same direction as long-term liabilities?

40. What was the amount of the change in the balance in retained earnings between January 28, 2017, and January 30, 2016? What caused this change?

41. Compute the current ratio at January 28, 2017, and January 30, 2016. What does this ratio indicate about Target?

42. Calculate the debt-to-assets ratios for the years ended January 28, 2017, and January 30, 2016. In which year did Target appear to have the highest financial risk?

43. Calculate the inventory turnover ratios and the average number of days to sell inventory for the years ended January 28, 2017, and January 30, 2016. In which year was the turnover and days to sell inventory more favorable?

44. Does the company’s common stock have a par value? If so, how much was the par value per share?

45. How many shares of common stock were issued as of January 28, 2017, and January 30, 2016?

46. How many shares of treasury stock did the company have as of January 28, 2017, and January 30, 2016? How were the treasury stock purchases reflected on the statement of cash flows? Include the type of cash flow activity.

47. What percentage of stockholders’ equity do the following items represent at each year end (January 28, 2017, and January 30, 2016)?

48. Does Target report cash flows from operating activities using the direct or the indirect method? Describe how you can tell.

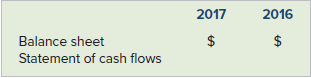

49. What was the dollar amount of the increase or decrease in cash and cash equivalents for the fiscal years 2016, 2015, and 2014?

50. Does the ending balance of cash and cash equivalents agree with the amount reported on the balance sheet for years ended January 28, 2017, and January 30, 2016?

51. Identify the four largest individual cash flow items (inflows or outflows) for the year ended January 28, 2017.

52. On which statement(s) would you expect to find information regarding the declaration and payment of dividends? What amount of dividends did Target pay in 2016? What amount of dividends did Target declare in 2016? Briefly explain why these amounts are not the same.

53. In your own words, briefly summarize two significant accounting policies.

54. When does Target recognize the revenue earned from the sale and use of “gift cards”?

55. While there are Target-brand credit cards, Target does not actually own or administer them. Who does, and how much did Target earn in 2016 and 2015 from Target-branded credit cards?

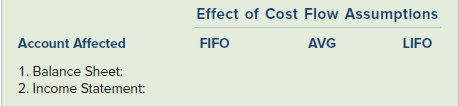

56. Using the following schedule, identify which accounts on the balance sheet and income statement are affected by a company’s inventory cost flow assumption. Also, identify the effects that the three inventory cost flow assumptions, FIFO, weighted-average, and LIFO have on the amounts reported on the balance sheet and income statement. Specifically, identify which cost flow assumption results in the highest, lowest, and middle dollar amount that is reported in the relevant account on each statement. Assume that prices are rising.

57. What inventory cost flow method does Target use?

58. What are the estimated useful lives of the company’s depreciable assets?

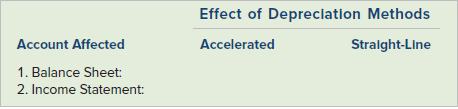

59. Using the following schedule, identify which accounts on the balance sheet and income statement are affected, given the two types of depreciation methods a company may use (accelerated versus straight-line). Also, assuming it is the first year a depreciable asset is used, identify the effects that the two depreciation methods have on the amounts reported on the balance sheet and income statement. Specifically, identify which method results in the highest dollar amount reported, and which results in the lowest.

60. What method of depreciation does Target use?

61. Did the balance in the goodwill account increase or decrease? Speculate as to what caused this change.

62. In addition to goodwill, what kinds of intangible assets does the company have? What are their estimated lives?

63. Identify three different accrued expenses.

64. Identify two kinds of commitments and contingencies.

65. What is the amount of available unsecured revolving credit? What was the balance outstanding at the end of each fiscal year?

66. What is the amount of total long-term borrowings at January 28, 2017? What was the weighted-average interest rate on Target’s notes payable and debentures for 2016? Other than”long-term debt and other borrowings,” what are the other long-term liability items reported on the balance sheet?

67. Compute the return-on-assets ratio (use net income rather than EBIT in the numerator) for the years ended January 28, 2017, and January 30, 2016.

68. Compute the return-on-equity ratio for the years ended January 28, 2017, and January 30, 2016.

69. Were the return-on-equity ratios greater or lesser than the return-on-assets ratios? Explain why.

70. What were Target’s basic earnings per share (EPS) for the years ended January 28, 2017, and January 30, 2016? Identify what caused the ratio to change.

Goodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Intangible Assets

An intangible asset is a resource controlled by an entity without physical substance. Unlike other assets, an intangible asset has no physical existence and you cannot touch it.Types of Intangible Assets and ExamplesSome examples are patented... Inventory Turnover Ratio

Inventory Turnover RatioThe inventory turnover ratio is a ratio of cost of goods sold to its average inventory. It is measured in times with respect to the cost of goods sold in a year normally. Inventory Turnover Ratio FormulaWhere,... Debentures

Debenture DefinitionDebentures are corporate loan instruments secured against the promise by the issuer to pay interest and principal. The holder of the debenture is promised to be paid a periodic interest and principal at the term. Companies who... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Common Stock

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Par Value

Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,...

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds