The following information is from the records of attorney Glenn Price. Write a brief explanation of the

Question:

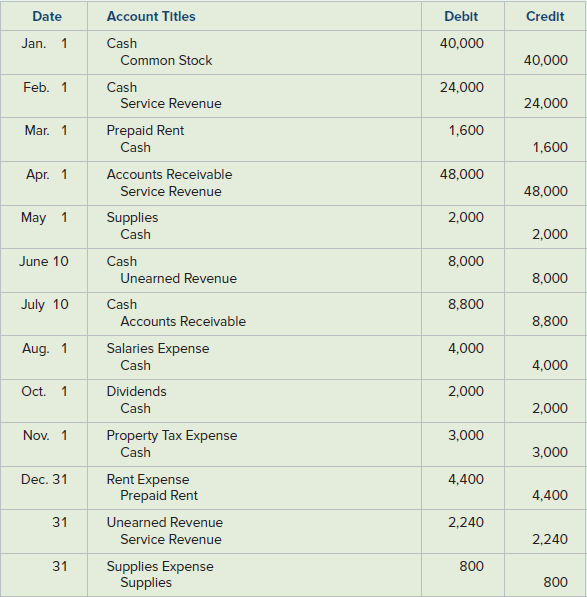

The following information is from the records of attorney Glenn Price. Write a brief explanation of the accounting event represented in each of the general journal entries.

Date Account Titles Deblt Credit 40,000 Jan. Cash Common Stock 40,000 24,000 Feb. 1 Cash Service Revenue 24,000 Prepaid Rent Mar. 1 1,600 Cash 1,600 Apr. 1 Accounts Receivable 48,000 48,000 Service Revenue May 1 Supplies 2,000 Cash 2,000 June 10 Cash 8,000 Unearned Revenue 8,000 July 10 Cash 8,800 Accounts Receivable 8,800 Aug. 1 Salaries Expense Cash 4,000 4,000 Oct. 1 Dividends 2,000 Cash 2,000 Nov. 1 Property Tax Expense 3,000 3,000 Cash Dec. 31 Rent Expense Prepaid Rent 4,400 4,400 31 Unearned Revenue 2,240 Service Revenue 2,240 31 Supplies Expense Supplies 800 800

Step by Step Answer:

Entry Date Description of Transaction January 1 Acquired cash from the issu...View the full answer

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds

Related Video

Unearned revenue is money received by an individual or company for a service or product that has yet to be provided or delivered. It can be thought of as a \"prepayment\" for goods or services that a person or company is expected to supply to the purchaser at a later date. As a result of this prepayment, the seller has a liability equal to the revenue earned until the good or service is delivered. This liability is noted under current liabilities, as it is expected to be settled within a year.

Students also viewed these Business questions

-

Required The following information is from the records of attorney Glenn Price. Write a brief explanation of the accounting event represented in each of the general journal entries. Debit 40,000...

-

The following information is from the records of attorney Matt Black. Write a brief explanation of the accounting event represented in each of the general journalentries. Debit Credit Date Jan. Feb....

-

The following information is from the accounting records of Khalid Company: Statement of Earnings Data For the Year Ended December 31, 2011 Sales..$142,000 Cost of goods sold (84,000) Depreciation...

-

Consider the following chair conformation of bromocyclohexane: (a) Identify whether the bromine atom occupies an axial position or an equatorial position in the conformation above. (b) Draw a...

-

Take the plant tour at Workhorse - A New Breed (web.archive.org/web/20101225143941/workhorse.com/default.aspx?tabid=116). What layout is presented in the tour? Consider how the layout could be...

-

Southeastern Foods has hired you to analyze their distribution-system design. The company has 11 distribution centers, with monthly volumes as listed below. Seven of these sites can support...

-

Grab users satisfaction. Refer to the research data for users satisfaction with the services provided by Grab, Exercise 8.72 (p. 496). Recall that the respondents comprised 60 staff and students at...

-

Wayne Kaegi's Verde Vineyards in Oakville, California, produces three varieties of wine: Merlot, Viognier, and Pinot Noir. His winemaster, Russel Hansen, has identified the following activities as...

-

17 In most companies, current liabilities are paid within ut of Select one: a. The answer does not exist Jestion b. the operating cycle out of current assets. C. one year through the creation of...

-

You are a CPA working in a tax group of a medium-sized accounting firm, Smith & Ross LLP. This morning, the partner of a tax group approached you regarding new clients, Cali and Tobey Carson....

-

The preceding 13 different accounting events are presented in general journal format. Use a horizontal statements model to show how each event affects the balance sheet, income statement, and...

-

Each of the following independent events requires a year-end adjusting entry. Record each event and the related adjusting entry in general journal format. The first event is recorded as an example....

-

Explain the meaning of assets, liabilities, and stockholders equity, and state the basic accounting equation. AppendixLO1

-

Evaluate the following integrals: (i) (ii) dx (x+1)(x+2) dx x(x+1)

-

Evaluate the following integrals:

-

Evaluate the following integrals:

-

Example: Evaluate each of the following: In(1+m) (a) e cos(1-e)dx 10- (b) [Int] -dt sec(3P)tan (3P) (c) 12 2+ sec(3P) dP (d) cos(x)cos(sin(x))dx (e) dw W 50 20

-

Form a team with several students who have chosen the same side in the dispute from Sharpening Your Communication Skills. In a debate against another team that has taken the other side in the...

-

Chicago Company sold merchandise to a customer for $1,500 cash in a state with a 6% sales tax rate. The total amount of cash collected from the customer was $558. $600. $642. $636. Nevada Company...

-

Required Using Tables I, II, III, or IV in this appendix, calculate the following: a. The future value of $30,000 invested at 8 percent for 10 years. b. The future value of eight annual payments of...

-

Barry Rich is a business major at State U. He will be graduating this year and is planning to start a consulting business. He will need to purchase computer equipment that costs $25,000. He can...

-

Billy Dan and Betty Lou were recently married and want to start saving for their dream home. They expect the house they want will cost approximately $325,000. They hope to be able to purchase the...

-

Ray Company provided the following excerpts from its Production Department's flexible budget performance report. Required: Complete the Production Department's Flexible Budget Performance Report....

-

Problem 1 5 - 5 ( Algo ) Lessee; operating lease; advance payment; leasehold improvement [ L 0 1 5 - 4 ] On January 1 , 2 0 2 4 , Winn Heat Transfer leased office space under a three - year operating...

-

Zafra and Stephanie formed an equal profit- sharing O&S Partnership during the current year, with Zafra contributing $100,000 in cash and Stephanie contributing land (basis of $60,000, fair market...

Study smarter with the SolutionInn App