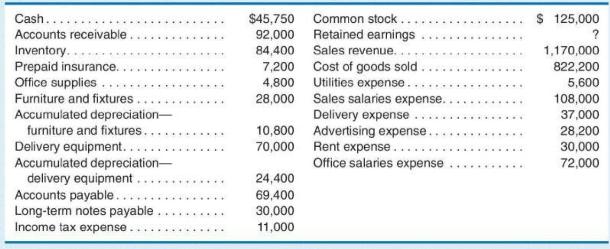

Washington Distributors, whose accounting year ends on December 31, had the following normal balances in its ledger

Question:

Washington Distributors, whose accounting year ends on December 31, had the following normal balances in its ledger accounts at December 31:

During the year, the accounting department prepared monthly statements, but no adjusting entries were made in the journals and ledgers. Data for the year-end procedures are as follows:

1. Prepaid insurance, December 31 , was \(\$ 2,800\).

2. Depreciation expense on furniture and fixtures for the year was \(\$ 3,000\).

3. Depreciation expense on delivery equipment for the year was \(\$ 10,000\).

4. Salaries payable, December 31 ( \(\$ 2,300\) sales and \(\$ 800\) office), was \(\$ 3,100\).

5. Office supplies on hand, December 31 , were \(\$ 1,900\).

Required

a. Record the necessary adjusting entries in general journal form at December 31 .

b. Prepare a multi-step income statement for the year. Combine all the operating expenses into one line on the income statement for selling, general and administrative expenses.

Step by Step Answer: