Zolnick Enterprises has two hourly employees: Kelly and Jon. Both employees earn overtime at the rate of

Question:

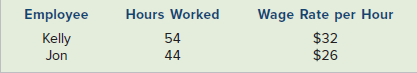

Zolnick Enterprises has two hourly employees: Kelly and Jon. Both employees earn overtime at the rate of 1½ times the hourly rate for hours worked in excess of 40 per week. Assume the Social Security tax rate is 6 percent on the first $110,000 of wages, and the Medicare tax rate is 1.5 percent on all earnings. Federal income tax withheld for Kelly and Jon was $260 and $220, respectively, for the first week of January. The following information is for the first week in January Year 1:

Required

a. Calculate the gross pay for each employee for the week.

b. Calculate the net pay for each employee for the week.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds

Question Posted: