a. Look at the Mini-S&P 500 contract in Figure 22.1. If the margin requirement is 10% of

Question:

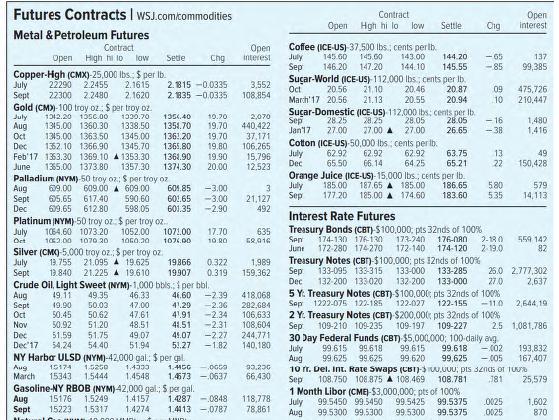

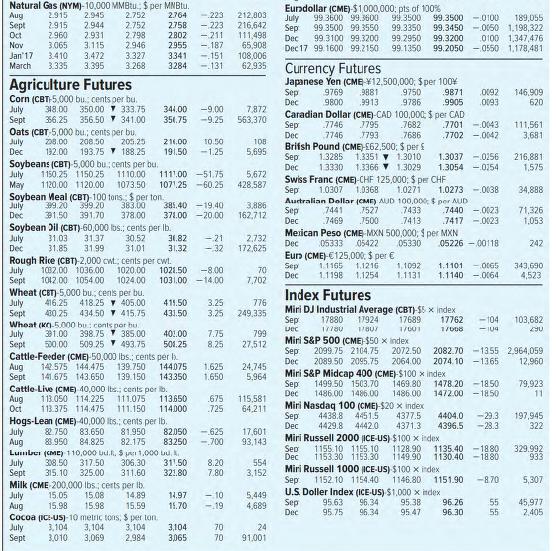

a. Look at the Mini-S&P 500 contract in Figure 22.1. If the margin requirement is 10% of the futures price times the contract multiplier of $50, how much must you deposit with your broker to trade the September maturity contract?

b. If the September futures price were to increase to 2,090, what percentage return would you earn on your net investment if you entered the long side of the contract at the price shown in the figure?

c. If the September futures price falls by 1 %, what is your percentage return?

Transcribed Image Text:

Futures Contracts | WSJ.com/commodities Metal & Petroleum Futures Contract Open High hi lo low Setle July Copper-High (CMX)-25,000 lbs.; $ per lb. July 22290 2.2455 2.1615 Sept 22300 2.2480 2.1620. Gold (CM))-100 troy oz: $ per troy oz. 1012.20 1350.00 1030.70 1354.40 10.70 2,070 1345.00 1360.30 1338.50 1351.70 19.70 440,422 Oct 1345.00 1363.50 1345.00 1361.20 19,70 37,171 Dec 1352 10 1366.90 1345.70 1365.80 19.80 106,265 Feb 17 1353.30 1369.101353.30 1361.90 19.90 June 1374.30 20.00 Aug 1355.00 1373.80 1357.30 Palladium (NVM)-50 troy oz; $ per troy oz 609.00 609.00 617.40 Aug 609.00 Sept 605.65 590.60 Dec 609.65 612.80 598.05 49.35 46.33 49.90 50.03 47.00 50.45 50.62 47.61 48.51 50.92 51.20 49.07 Dec 51.59 51.75 Dec 17 54,24 54.40 51.94 Platinum (NYM)-50 troy oz. $ per troy oz.. Oct July 1064.60 1073.20 1052.00 1071.00 102.00 1070 20 1050.30 107.00 Silver (CMO)-5.000 troy oz.: $ per troy oz. July 13.755 21.095 A 19.625 19866 0.322 Sept 13.840 21.225 A 19.610 19907 0.319 Crude Oil, Light Sweet (NYM)-1,000 bbls.: i per bbl. Aug 49,11 46.60 -2.39 41.29 -2.36 Sept Oct 41.91 -2.34 Nov 41.51 -2.31 45.07 -2.27 51.27 -1.82 Aug Sept Nat NY Harbor ULSD (NYM)-42,000 gal.; $ per gal 1.456 Aug 15174 1.5250 March 15343 1.5444 1.4673 1.4333 1.4548 Gasoline-NY RBOB (NYM) -42,000 gal.; $ per gal 15176 1.5249 1.4157 15223 1.5317 1.4274 Chg 2.1815 -0.0335 3,552 2.1835 -0.0335 108,854 601.85 -3.00 -3.00 601.65 601.35 -2.90 C-10 m. 17.70 10.00 Open interest -0000 -0637 1.4287 0848 1.4413 0787 ruunu 15,796 12.523 3 21,127 492 635 52,016 1,989 159,362 418,068 282,684 106,633 108,604 244,771 140,180 93.230 66,430 118,778 78,861 Contract Open High hi lo low Settle. Coffee (ICE-US) 37.500 lbs.; cents perlb July 145.60 143.00 145.00 144.20 Sep 146.20 147.20 144.10 145.55 Suçar-World (ICE-US)-112.000 lbs; cents per lb. Oct 20.56 21.10 20.46 20.87 March 17 20.56 21.13 20.55 20.94 Suçar-Domestic (ICE-US) 112,000 lbs: cents per lb. 28.25 28.05 28.25 27.00 27.00 A 26.65 Sep Jan 17 Cotton (ICE-US)-50,000 lbs 62.92 July Dec 66.14 July Sep 62.92 65.50 28.05 27.00 cents per lb. 62.92 64.25 Orange Juice (ICE-US)-15,000 lbs.; cents per lb. 186.65 185.00 177,20 187.65A 185.00 185.00 174.60 183.60 63.75 65.21 5 Y: Treasury Notes (CBT)-$100,000 Sep 1222-075 122-185 122-027 Open Cig interest -65 -85 09 10 -16 -38 5.80 5.35 137 99,385 13 49 22 150,428 475,726 210,447 30 Day Federal Funds (CBT) $5,000,000; 100-daily avg. July 99.615 99.518 99.615 99.618 -002 Aug 99,625 99.625 99.620 99,625 -005 1,480 1,416 Interest Rate Futures Treasury Bonds (CBT)-$100,000, pts 32nds of 100% Sep 174-130 176-130 173-740 176-080 2-180 June 172-280 174-270 172-140 174-120 2 19.0 Treasury Notes (CBT)-$100,000; pts 12nds of 100% Sep 133-095 133-315 133-000 133-285 25.0 2.777,302 Dec 132-200 133020 132-200 133-000 27/0 2,637 pts 32nds of 100% 122-155 -110 2,644,19 2 Y. Treasury Notes (CBT) $200,000 pts 32nds of 100% 109-210 109-235 109-197 109-227 Sep 1 Month Libor (CME)-$3,000,000, pts of 100%. 0025 July 99.5450 99.5450 99.5425 99.5375 Aug 99.5300 99.5300 99.5300 99.5375 0025 579 14,113 2.5 1,081,786 559 142 82 193,832 167,407 10 rr. Del. Int. Rate Swaps (CBT)300.000, pts 32nds of 100% 108.750 108.875 A 108.469 Sep 108.781 181 25,579 1,602 870

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 16% (6 reviews)

a As of July 6 2016 the required initial margin on the September Mini SP futures co...View the full answer

Answered By

Branice Buyengo Ajevi

I have been teaching for the last 5 years which has strengthened my interaction with students of different level.

4.30+

1+ Reviews

10+ Question Solved

Related Book For

Investments

ISBN: 9781259271939

9th Canadian Edition

Authors: Zvi Bodie, Alex Kane, Alan Marcus, Lorne Switzer, Maureen Stapleton, Dana Boyko, Christine Panasian

Question Posted:

Students also viewed these Business questions

-

You have an arrangement with your broker to request 1000 shares of all available IPOs. Suppose that 10% of the time, the IPO is "very successful" and appreciates by 100% on the first day, 80% of the...

-

A look at the industrial sector of an economy can be simplified to include three industries: the mining industry, the manufacturing industry, and the fuels industry. The technology matrix for this...

-

How much must you deposit at the end of each year in an account that pays a nominal annual rate of 20 percent, if at the end of five years you want $10,000 in the account?

-

A. Determine the cost of the goods sold for the September 30 sale. B. Determine the inventory on September 30. Beginning inventory, purchases, and sales for an inventory item are as follows: 31 units...

-

Suppose the probability that you get an interesting piece of mail on any given weekday is 1y20. Is the probability that you get at least one interesting piece of mail during the week (Monday to...

-

Consider the ammonia (NH 3 ) molecule. (a) If you have 1 mole of ammonia, how many moles of H atoms do you have? (b) If you have 2 moles of ammonia, how many moles of H atoms do you have? (c) If you...

-

Identify five different business models and classify them. LO.1

-

Nowjuice, Inc., produces Shakewell fruit juice. A planner has developed an aggregate forecast for demand (in cases) for the next six months. Develop an aggregate plan using each of the following...

-

Exercise 12-5 (Algo) Preference Ranking [LO12-5] Information on four investment proposals is given below: Required: 1. Compute the profitabilify index for each investment proposal. (Round your...

-

A famous product photographer Xavier is in high demand and is being approached by various companies to get their products photographed. Xavier does all of this product shoots at his studio and wants...

-

Long-term Treasury bonds currently are selling at yields to maturity of nearly 6%. You expect interest rates to fall. The rest of the market thinks that they will remain unchanged over the coming...

-

Use the Black- Scholes formula to find the value of a call option on the following stock: Time to expiration Standard deviation Exercise price Stock price Interest rate 6 months 50% per year $50 $50...

-

Current discussions by the Boards leave room open for two accounting for Leases Standards; one for lessee and another one for lessor. Should two accounting for Leases Standards be issued? Support...

-

What are the different types of drones?

-

What are the applications of drones?

-

What are the various protocols in telecom domain?

-

What are the various types of routing protocols?

-

For all the benefits they bring to business, social media and other communication technologies have created a major new challenge: responding to online rumors and attacks on a company's reputation....

-

Seismic waves in the Earth. Surface seismic waves generated by an earthquake arrive at a distant observer after the arrival of P waves and S waves (Fig. 12.27B), partly because surface waves travel...

-

The registrar of a college with a population of N = 4,000 full-time students is asked by the president to conduct a survey to measure satisfaction with the quality of life on campus. The following...

-

The What Zit Company has decided to fund six of nine project proposals for the coming budget year. Determine the next capital budget for What Zit. What is the MARR? Annual Life First Cast Project...

-

Which projects should be done if the budget is $100,000? What is the opportunity cost of capital? Annual Salvage Value Life Project (years) First Cost Benefit $20,000 20,000 20,000 $4000 20 $20,000...

-

Economic analysis and decision making in the public sector is often called "a multi-actor or multi-stakeholder decision problem." Explain what this phrase means. .

-

A stock is expected to pay a dividend of $1.50 at the end of the year (i.e., D 1 = $1.50), and it should continue to grow at a constant rate of 10% a year. If its required return is 14%, what is the...

-

The Hobby Shop has a checking account with a ledger balance of $1,700. The firm has $2,400 in uncollected deposits and $4,200 in outstanding checks. What is the amount of the disbursement float on...

-

An investment will pay you $34,000 in 11 years. If the appropriate discount rate is 6.1 percent compounded daily, what is the present value? (Use 365 days a year. Do not round intermediate...

Study smarter with the SolutionInn App