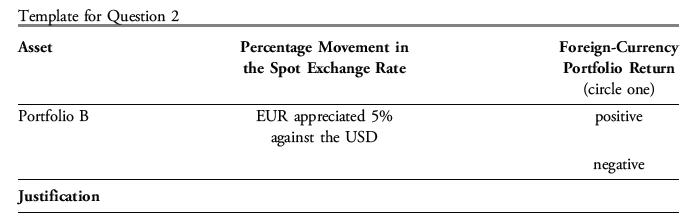

Analyze the foreign-currency return for Portfolio B. Justify your choice. The fund manager of Portfolio B is

Question:

Analyze the foreign-currency return for Portfolio B. Justify your choice.

The fund manager of Portfolio B is evaluating an internally-managed 100% foreigncurrency hedged strategy.

Kamala Gupta, a currency management consultant, is hired to evaluate the performance of two portfolios. Portfolio A and Portfolio B are managed in the United States and performance is measured in terms of the US dollar (USD). Portfolio A consists of British pound (GBP) denominated bonds and Portfolio B holds euro (EUR) denominated bonds.

Gupta calculates a 19.5% domestic-currency return for Portfolio A and 0% domesticcurrency return for Portfolio B.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: