As chief investment officer of a small endowment fund, you are considering expanding the fund's strategic asset

Question:

As chief investment officer of a small endowment fund, you are considering expanding the fund's strategic asset allocation from just common stock (CS) and fiXed-income (FI) to include private real estate partnerships (PR) as well:

Current Allocation: 60 percent of Asset CS, 40 percent of Asset FI Proposed Allocation: 50 percent of Asset CS, 30 percent of Asset FI, 20 percent of Asset PR

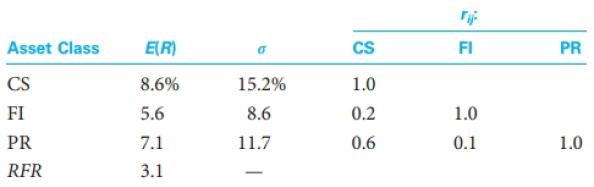

You also consider the following historical data for the three risky asset classes (CS, FI, and PR) and the risk-free rate (RFR) over a recent investment period:

You have already determined that the expected return and standard deviation for the Current Allocation are: E(Rarrrent) = 7.40 percent and σcurrcnt = 10.37 percent

a. Calculate the expected return for the Proposed Allocation.

b. Calculate the standard deviation for the Proposed Allocation.

c. For both the Current and Proposed Allocations, calculate the expected risk premium per unit of risk (that is, [E(Rp) - RFR]/σ).

d. Using your calculations from part (c), explain which of these two portfolios is the most likely to fall on the Markowitz efficient frontier.

Common StockCommon stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Expected Return

The expected return is the profit or loss an investor anticipates on an investment that has known or anticipated rates of return (RoR). It is calculated by multiplying potential outcomes by the chances of them occurring and then totaling these...

Step by Step Answer:

Investment Analysis and Portfolio Management

ISBN: 978-1305262997

11th Edition

Authors: Frank K. Reilly, Keith C. Brown, Sanford J. Leeds