Assuming that a one-year call option with an exercise price of $28 is available for the stock

Question:

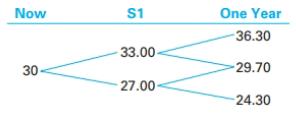

Assuming that a one-year call option with an exercise price of $28 is available for the stock of the DEW Corp., consider the following is a two-period price tree for DEW stock over the next year:

You also know that the risk-free rate is RFR = 5 percent per subperiod (or 10.25 percent annualized).

a. If the sequence of stock prices that DEW stock follows over the year is $30.00, $33.00, and $29.70, describe the composition of the initial riskless portfolio of stock and options you would form and all the subsequent adjustments you would have to make to keep this portfolio riskless.

b. Given the initial DEW price of $30, what are the probabilities of observing each of the three-terminal stock prices in one year? (In arriving at your answer, it will be useful to consider (1) the number of different ways that a particular terminal price could be achieved and (2) the probability of an up or down movement.)

c. Use the binomial option model to calculate the present value of this call option.

d. Calculate the value of a one-year put option on DEW stock having an exercise price of $28; be sure your answer is consistent with the correct response to part (c).

PortfolioA portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer:

Investment Analysis and Portfolio Management

ISBN: 978-1305262997

11th Edition

Authors: Frank K. Reilly, Keith C. Brown, Sanford J. Leeds