Based on Exhibit 1, the domestic-currency return over the last year (measured in EUR terms) was higher

Question:

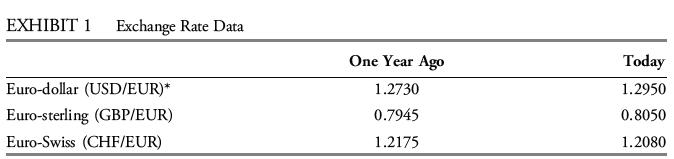

Based on Exhibit 1, the domestic-currency return over the last year (measured in EUR terms) was higher than the foreign-currency return for:

A. USD-denominated assets.

B. GBP-denominated assets.

C. CHF-denominated assets.

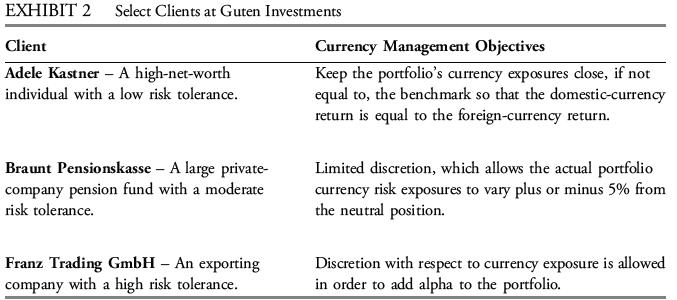

Guten Investments GmbH, based in Germany and using the EUR as its reporting currency, is an asset management firm providing investment services for local high-net-worth and institutional investors seeking international exposures. The firm invests in the Swiss, UK, and US markets, after conducting fundamental research in order to select individual investments.

Exhibit 1 presents recent information for exchange rates in these foreign markets.

In prior years, the correlation between movements in the foreign-currency asset returns for the USD-denominated assets and movements in the exchange rate was estimated to be þ0.50. After analyzing global financial markets, Konstanze Ostermann, a portfolio manager at Guten Investments, now expects that this correlation will increase to þ0.80, although her forecast for foreign-currency asset returns is unchanged.

Ostermann believes that currency markets are efficient and hence that long-run gains cannot be achieved from active currency management, especially after netting out management and transaction costs. She uses this philosophy to guide hedging decisions for her discretionary accounts, unless instructed otherwise by the client.

Ostermann is aware, however, that some investors hold an alternative view on the merits of active currency management. Accordingly, their portfolios have different investment guidelines. For these accounts, Guten Investments employs a currency specialist firm, Umlauf Management, to provide currency overlay programs specific to each client’s investment objectives. For most hedging strategies, Umlauf Management develops a market view based on underlying fundamentals in exchange rates. However, when directed by clients, Umlauf Management uses options and a variety of trading strategies to unbundle all of the various risk factors (the “Greeks”) and trade them separately.

Ostermann conducts an annual review for three of her clients and gathers the summary information presented in Exhibit 2.

Step by Step Answer: