Carmichaels most appropriate response to Schmidts question about the justified P/E ratio is: A. Lower volatility of

Question:

Carmichael’s most appropriate response to Schmidt’s question about the justified P/E ratio is:

A. Lower volatility of the U.S. equity market.

B. Higher inflation-adjusted dividend growth rate.

C. Higher correlation of U.S. equity market with international equity markets.

Use the following information to answer Question.

Egon Carmichael, CFA, is a senior analyst at Supranational Investment Management (Supranational), a firm specializing in global investment analysis. He is meeting with Nicolas Schmidt, a potential client representing a life insurance company, discussing a report prepared by Supranational on the U.S. equity market. The report contains valuations of the U.S. equity market based on two approaches: the justified P/E model and the Fed model.

When Carmichael informs Schmidt that Supranational applies the neoclassical approach to growth accounting, Schmidt makes the following statements about what he considers to be some limitations of that approach:

Statement 1: The growth in total factor productivity is not directly observable.

Statement 2: The growth factors must be stated in nominal (i.e., not inflation-adjusted) terms.

Statement 3: The total output may not grow at a rate faster than predicted by the growth in capital stock and in labor force.

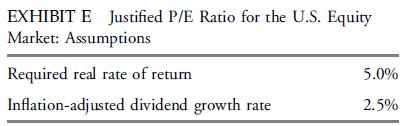

For use in estimating the justified P/E based on the Gordon constant growth model, Carmichael develops the assumptions displayed in Exhibit E.

Using these assumptions, Carmichael’s estimate of the justified P/E ratio for the U.S.

equity market is 13.2. Schmidt asks Carmichael, “All else equal, what would cause the justified P/E for the U.S. equity market to fall?”

Supranational’s report concludes that the U.S. equity market is currently undervalued, based on the Fed model. Schmidt asks Carmichael, “Which of the following scenarios would result in the Fed model most likely indicating that the U.S. equity market is overvalued?”

Scenario 1: The S&P 500 forward earnings yield is 4.5 percent and the 10-year T-note yield is 4.75 percent.

Scenario 2: The S&P 500 forward earnings yield is 4.5 percent, the 10-year T-note yield is 4.0 percent, and the average difference between the S&P 500 forward earnings yield and the 10-year T-note over the last 20 years has been 0.25 percent.

Scenario 3: The long-term inflation rate is expected to be 2 percent and the long-term average earnings growth is expected to be 1 percent real.

Schmidt points out that the Fed model has been the subject of criticism and recommends that Carmichael use the Yardeni model to value the U.S. equity market. Before employing the Yardeni model, Carmichael asks Schmidt to identify criticisms of the Fed model that are addressed by the Yardeni model.

Finally, Carmichael presents a third earnings-based approach, the P/10-year MA(E)

model, and describes many positive features of that model.

Schmidt mentions that the international life insurance company that he represents might be interested in the equity forecasts produced by Supranational. He says that his company’s objective is to accumulate sufficient assets to fulfill the firm’s obligations under its long term insurance and annuity contracts. For competitive reasons, the company wants to quickly detect significant cyclical turns in equity markets and to minimize tracking errors with respect to the equity index.

Schmidt asks Carmichael to identify the forecasting approach that is most appropriate.

Step by Step Answer:

Investments Principles Of Portfolio And Equity Analysis

ISBN: 9780470915806

1st Edition

Authors: Michael McMillan, Jerald E. Pinto, Wendy L. Pirie, Gerhard Van De Venter, Lawrence E. Kochard