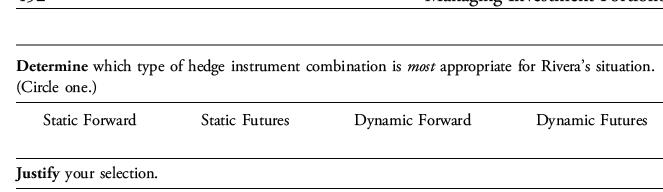

Determine which type of hedge instrument combination is most appropriate for Riveras situation. Justify your selection. Assume

Question:

Determine which type of hedge instrument combination is most appropriate for Rivera’s situation. Justify your selection.

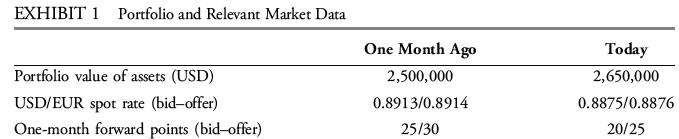

Assume Rivera’s portfolio was perfectly hedged. It is now time to rebalance the portfolio and roll the currency hedge forward one month. The relevant data for rebalancing are provided in Exhibit 1.

Rosario Delgado is an investment manager in Spain. Delgado’s client, Max Rivera, seeks assistance with his well-diversified investment portfolio denominated in US dollars.

Rivera’s reporting currency is the euro, and he is concerned about his US dollar exposure.

His portfolio IPS requires monthly rebalancing, at a minimum. The portfolio’s market value is USD2.5 million. Given Rivera’s risk aversion, Delgado is considering a monthly hedge using either a one-month forward contract or one-month futures contract.

Step by Step Answer: