Question:

For Subscriber 1, the most significant factor to consider would be:

A. margin requirements.

B. transaction costs of using futures contracts.

C. different quoting conventions for future contracts.

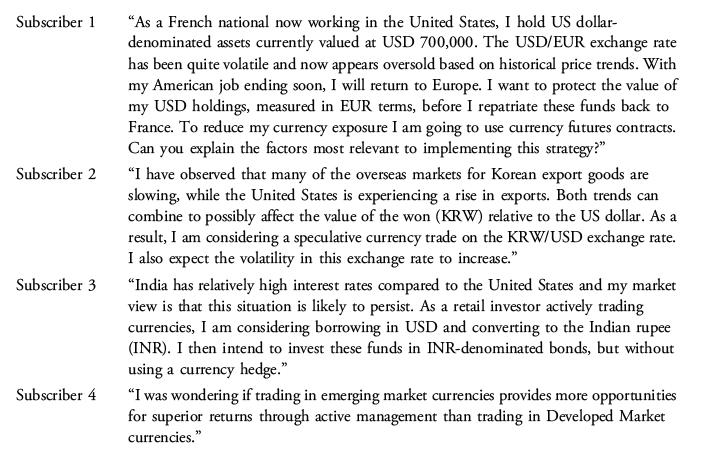

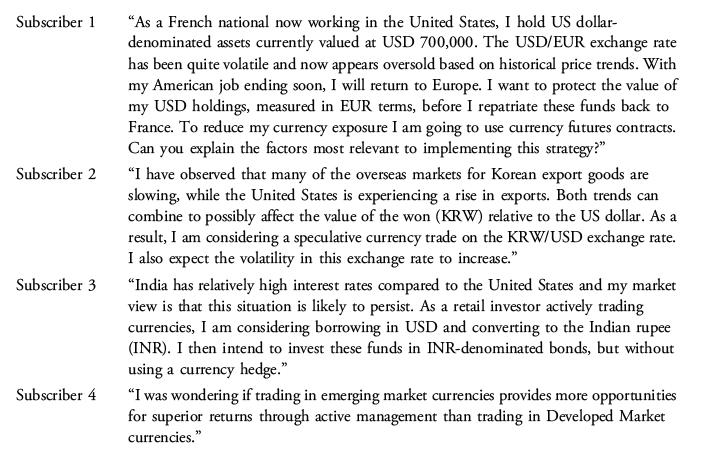

Li Jiang is an international economist operating a subscription website through which she offers financial advice on currency issues to retail investors. One morning she receives four subscriber e-mails seeking guidance.

Transcribed Image Text:

Subscriber 1 Subscriber 2 Subscriber 3 Subscriber 4 "As a French national now working in the United States, I hold US dollar- denominated assets currently valued at USD 700,000. The USD/EUR exchange rate has been quite volatile and now appears oversold based on historical price trends. With my American job ending soon, I will return to Europe. I want to protect the value of my USD holdings, measured in EUR terms, before I repatriate these funds back to France. To reduce my currency exposure I am going to use currency futures contracts. Can you explain the factors most relevant to implementing this strategy?" "I have observed that many of the overseas markets for Korean export goods are slowing, while the United States is experiencing a rise in exports. Both trends can combine to possibly affect the value of the won (KRW) relative to the US dollar. As a result, I am considering a speculative currency trade on the KRW/USD exchange rate. I also expect the volatility in this exchange rate to increase." "India has relatively high interest rates compared to the United States and my market view is that this situation is likely to persist. As a retail investor actively trading currencies, I am considering borrowing in USD and converting to the Indian rupee (INR). I then intend to invest these funds in INR-denominated bonds, but without using a currency hedge." "I was wondering if trading in emerging market currencies provides more opportunities for superior returns through active management than trading in Developed Market currencies."