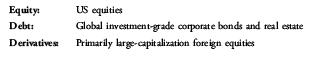

Raye believes the previous advisers asset class specifications for equity and derivatives are inappropriate given that, for

Question:

Raye believes the previous adviser’s asset class specifications for equity and derivatives are inappropriate given that, for purposes of asset allocation, asset classes should be:

A. diversifying.

B. mutually exclusive.

C. relatively homogeneous.

Meg and Cramer Law, a married couple aged 42 and 44, respectively, are meeting with their new investment adviser, Daniel Raye. The Laws have worked their entire careers at Whorton Solutions (WS), a multinational technology company. The Laws have two teenage children who will soon begin college.

Raye reviews the Laws’ current financial position. The Laws have an investment portfolio consisting of \($800\),000 in equities and \($450\),000 in fixed-income instruments. Raye notes that 80% of the equity portfolio consists of shares of WS. The Laws also own real estate valued at \($400\),000, with \($225\),000 in mortgage debt. Raye estimates the Laws’ preretirement earnings from WS have a total present value of \($1\),025,000. He estimates the Laws’ future expected consumption expenditures have a total present value of \($750\),000.

The Laws express a very strong desire to fund their children’s college education expenses, which have an estimated present value of \($275\),000. The Laws also plan to fund an endowment at their alma mater in 20 years, which has an estimated present value of \($500\),000. The Laws tell Raye they want a high probability of success funding the endowment. Raye uses this information to prepare an economic balance sheet for the Laws.

In reviewing a financial plan written by the Laws’ previous adviser, Raye notices the following asset class specifications.

The previous adviser’s report notes the asset class returns on equity and derivatives are highly correlated. The report also notes the asset class returns on debt have a low correlation with equity and derivative returns.

Raye is concerned that the asset allocation approach followed by the Laws’ previous financial adviser resulted in an overlap in risk factors among asset classes for the portfolio.

Raye plans to address this by examining the portfolio’s sensitivity to various risk factors, such as inflation, liquidity, and volatility, to determine the desired exposure to each factor.

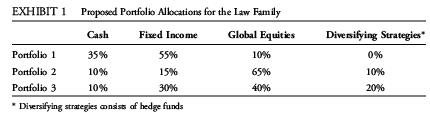

Raye concludes that a portfolio of 75% global equities and 25% bonds reflects an appropriate balance of expected return and risk for the Laws with respect to a 20-year time horizon for most moderately important goals. Raye recommends the Laws follow a goalsbased approach to asset allocation and offers three possible portfolios for the Laws to consider.

Selected data on the three portfolios are presented in Exhibit 1.

Raye uses a cost–benefit approach to rebalancing and recommends that global equities have a wider rebalancing range than the other asset classes.

Step by Step Answer: