The arrival cost for purchasing the 90,000 shares of BYYP is: A. 164.4 bp. B. 227.2 bp.

Question:

The arrival cost for purchasing the 90,000 shares of BYYP is:

A. 164.4 bp.

B. 227.2 bp.

C. 355.0 bp.

Robert Harding is a portfolio manager at ValleyRise, a hedge fund based in the United States.

Harding monitors the portfolio alongside Andrea Yellow, a junior analyst. ValleyRise only invests in equities, but Harding is considering other asset classes to add to the portfolio, namely derivatives, fixed income, and currencies. Harding and Yellow meet to discuss their trading strategies and price benchmarks.

Harding begins the meeting by asking Yellow about factors that affect the selection of an appropriate trading strategy. Yellow tells Harding:

Statement 1. Trading with greater urgency results in lower execution risk.

Statement 2. Trading larger size orders with higher trade urgency reduces market impact.

Statement 3. Securities with high rates of alpha decay require less aggressive trading to realize alpha.

After further discussion about Yellow’s statements, Harding provides Yellow a list of trades that he wants to execute. He asks Yellow to recommend a price benchmark. Harding wants to use a benchmark where the reference price for the benchmark is computed based on market prices that occur during the trading period, excluding trade outliers.

Earlier that day before the meeting, Yellow believed that the market had underreacted during the pre-market trading session to a strong earnings announcement from ABC Corp., a company that Yellow and Harding have been thoroughly researching for several months.

Their research suggested the stock’s fair value was \($90\) per share, and the strong earnings announcement reinforced their belief in their fair value estimate.

Right after the earnings announcement, the pre-market price of ABC was \($75\). Concerned that the underreaction would be short-lived, Harding directed Yellow to buy 30,000 shares of ABC stock. Yellow and Harding discussed a trading strategy, knowing that ABC shares are very liquid and the order would represent only about 1% of the expected daily volume. They agreed on trading a portion of the order at the opening auction and then filling the remainder of the order after the opening auction. The strategy for filling the remaining portion of the order was to execute trades at prices close to the market price at the time the order was received.

Harding and Yellow then shift their conversation to XYZ Corp. Harding tells Yellow that, after extensive research, he would like to utilize an algorithm to purchase some shares that are relatively liquid. When building the portfolio’s position in XYZ, Harding’s priority is to minimize the trade’s market impact to avoid conveying information to market participants.

Additionally, Harding does not expect adverse price movements during the trade horizon.

Harding and Yellow conclude their meeting by comparing trade implementation for equities with the trade implementation for the new fixed-income, exchange-traded derivatives, and currency investments under consideration. Yellow tells Harding:

Statement 4. Small currency trades and small exchange-traded derivatives trades are typically implemented using the direct market access (DMA) approach.

Statement 5. The high-touch agency approach is typically used to execute large, non-urgent trades in fixed-income and exchange-traded derivatives markets.

The next day, Harding instructs Yellow to revisit their research on BYYP, Inc. Yellow’s research leads her to believe that its shares are undervalued. She shares her research with Harding, and at 10 a.m. he instructs her to buy 120,000 shares when the price is \($40.00\) using a limit order of \($42.00\).

The buy-side trader releases the order for market execution when the price is \($40.50\).

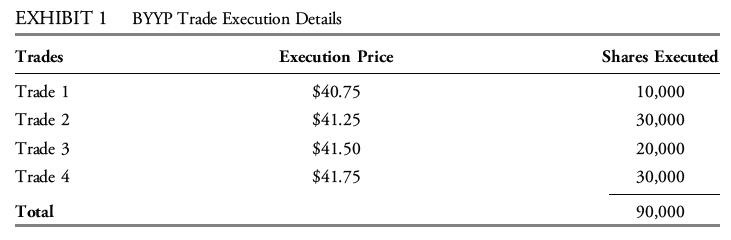

The only fee is a commission of \($0.02\) per share. By the end of the trading day, 90,000 shares of the order had been purchased, and BYYP closes at \($42.50\). The trade was executed at an average price of \($41.42\). Details about the executed trades are presented in Exhibit 1.

While the buy-side trader executes the BYYP trade, Harding and Yellow review ValleyRise’s trade policy document. After reviewing the document, Yellow recommends several changes: 1) add a policy for the treatment of trade errors; 2) add a policy that ensures over-the-counter derivatives are traded on venues with rules that ensure minimum price transparency; and 3) alter the list of eligible brokers to include only those that provide execution at the lowest possible trading cost.

Step by Step Answer: