The tax liability on the sale of the Steelworq shares is: A. ($4),000. B. ($0). C. ($33),020.

Question:

The tax liability on the sale of the Steelworq shares is:

A. −\($4\),000.

B. \($0\).

C. \($33\),020.

Jevan Chen is a tax adviser who provides tax-aware advice to various private clients. Two of Chen’s clients are Sameeha Payne and Chaow Yoonim, who are US citizens and reside in the United States. A third client, LaShawna Kaminski, lives in a tax jurisdiction with a flat tax rate of 20%, which applies to all types of income and capital gains.

Payne is the founder and sole owner of Solar Falls Power, a privately held renewable energy company located in the United States. In addition to owning Solar Falls Power, Payne is also the sole owner of the property that the company uses as its headquarters. The vast majority of Payne’s wealth is represented by these two assets. Payne’s tax cost basis in each asset is close to zero.

Payne consults with Chen to develop a strategy to mitigate the risk associated with the two concentrated ownership positions. Payne’s primary objective is to mitigate the concentration risk of both positions without triggering a taxable event while maintaining sole ownership. Payne’s secondary objective is to monetize the property.

Payne is considering becoming a resident of Singapore, which operates under a territorial tax system, while maintaining her US citizenship. She contacts Chen to discuss tax implications related to the potential change in residency. She asks Chen the following taxrelated question:

As a US citizen, if I become a resident of Singapore, would I be taxed (1) only on income earned where I am a resident, (2) only on income earned where I am a citizen, or (3) on all income earned worldwide?

Chen next advises Yoonim, who recently inherited shares of Steelworq from a relative who passed away. Yoonim’s deceased relative was a resident of the United States, which is a country that uses a “step-up” in basis at death. The deceased relative purchased the Steelworq shares 20 years ago for \($14\),900 (including commissions and other costs). At the time of the relative’s death, the Steelworq shares had a market value of \($200\),000, and Yoonim recently sold the shares for \($180\),000. Yoonim’s capital gains tax rate is 20%.

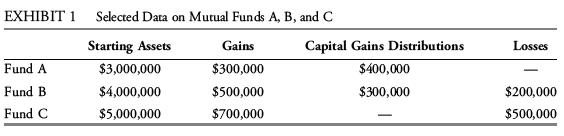

Yoonim seeks to diversify his portfolio by using the proceeds from the sale of Steelworq shares to invest in mutual funds. Yoonim’s investment adviser identifies three mutual funds, and Yoonim asks Chen to determine which fund will be the most tax efficient going forward.

Selected data for the three mutual funds is presented in Exhibit 1.

Yoonim next asks Chen to evaluate Mutual Fund D, which has an embedded gain of 5%

of the ending portfolio value. Yoonim asks Chen to calculate a post-liquidation return over the most recent three-year period. Mutual Fund D exhibited after-tax returns of 7.0% in Year 1, 3.3% in Year 2, and 7.5% in Year 3, and capital gains are taxed at a 20% rate.

Finally, Chen turns his attention to Kaminski, who currently has \($1\) million invested in a tax-deferred account earning 7% per year. Kaminski will sell this investment at the end of five years, withdraw the proceeds from the sale in a lump sum, and use those proceeds to fund the purchase of a vacation home. Kaminski asks Chen to calculate the after-tax wealth that will be available in five years.

Step by Step Answer: