To satisfy Winthrops benchmark and security selection specifications, the Canadian equity index benchmark Tong selects should be:

Question:

To satisfy Winthrop’s benchmark and security selection specifications, the Canadian equity index benchmark Tong selects should be:

A. small-capitalization with a core tilt.

B. large-capitalization with a value tilt.

C. mid-capitalization with a growth tilt.

Evan Winthrop, a senior officer of a US-based corporation, meets with Rebecca Tong, a portfolio manager at Cobalt Wealth Management. Winthrop recently moved his investments to Cobalt in response to his previous manager’s benchmark-relative underperformance and high expenses.

Winthrop resides in Canada and plans to retire there. His annual salary covers his current spending needs, and his vested defined benefit pension plan is sufficient to meet retirement income goals. Winthrop prefers passive exposure to global equity markets with a focus on low management costs and minimal tracking error to any index benchmarks. The fixed-income portion of the portfolio may consist of laddered maturities with a home-country bias.

Tong proposes using an equity index as a basis for an investment strategy and reviews the most important requirements for an appropriate benchmark. With regard to investable indexes, Tong tells Winthrop the following:

Statement 1. A free-float adjustment to a market-capitalization weighted index lowers its liquidity.

Statement 2. An index provider that incorporates a buffering policy makes the index more investable.

Winthrop asks Tong to select a benchmark for the domestic stock allocation that holds all sectors of the Canadian equity market and to focus the portfolio on highly liquid, wellknown companies. In addition, Winthrop specifies that any stock purchased should have a relatively low beta, a high dividend yield, a low P/E, and a low price-to-book ratio (P/B).

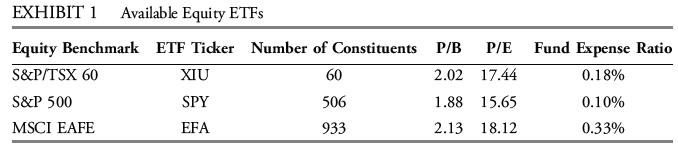

Winthrop and Tong agree that only the existing equity investments need to be liquidated. Tong suggests that, as an alternative to direct equity investments, the new equity portfolio be composed of the exchange-traded funds (ETFs) shown in Exhibit 1.

Winthrop asks Tong about the techniques wealth managers and fund companies use to create index-tracking equity portfolios that minimize tracking error and costs. In response, Tong outlines two frequently used methods:

Method 1. One process requires that all index constituents are available for trading and liquid, but significant brokerage commissions can occur when the index is large.

Method 2. When tracking an index with a large number of constituents and/or managing a relatively low level of assets, a relatively straightforward and technically unsophisticated method can be used to build a passive portfolio that requires fewer individual securities than the index and reduces brokerage commission costs.

Tong adds that portfolio stocks may be used to generate incremental revenue, thereby partially offsetting administrative costs but potentially creating undesirable counterparty and collateral risks.

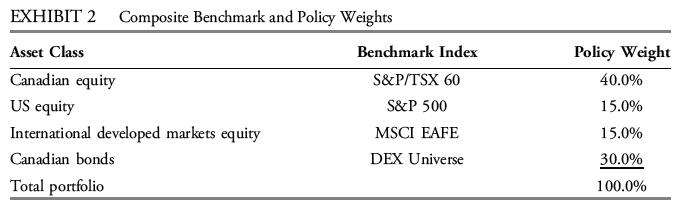

After determining Winthrop’s objectives and constraints, the CAD147 million portfolio’s new strategic policy is to target long-term market returns while being fully invested at all times. Tong recommends quarterly rebalancing, currency hedging, and a composite benchmark composed of equity and fixed-income indexes. Currently the USD is worth CAD1.2930, and this exchange rate is expected to remain stable during the next month. Exhibit 2 presents the strategic asset allocation and benchmark weights.

In one month, Winthrop will receive a performance bonus of USD5,750,000. He believes that the US equity market is likely to increase during this timeframe. To take advantage of Winthrop’s market outlook, he instructs Tong to immediately initiate an equity transaction using the S&P 500 futures contract with a current price of 2,464.29 while respecting the policy weights in Exhibit 2. The S&P 500 futures contract multiplier is 250, and the S&P 500 E-mini multiplier is 50.

Tong cautions Winthrop that there is a potential pitfall with the proposed request when it comes time to analyze performance. She discloses to Winthrop that equity index futures returns can differ from the underlying index, primarily because of corporate actions such as the declaration of dividends and stock splits.

Step by Step Answer: