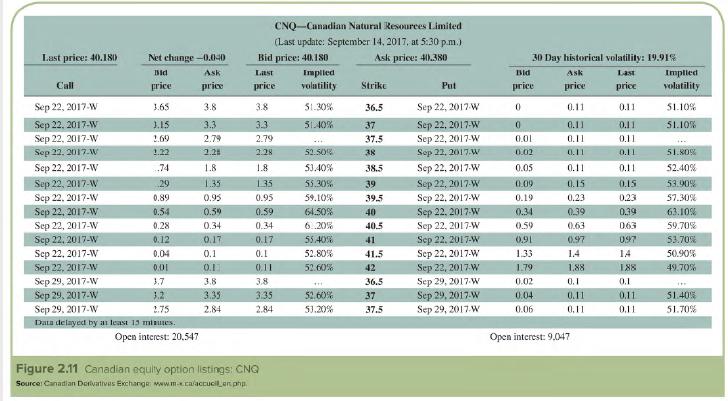

Turn to Figure 2.11 and find the options for Canadian Natural Resources. Suppose you buy a September

Question:

Turn to Figure 2.11 and find the options for Canadian Natural Resources. Suppose you buy a September 22 call option with exercise price of $39, and the stock price at the expiration is $41.

a. Will you exercise your call? What are the profit and rate of return on your position?

b. What, if you had bought the call with exercise price $40 and the stock price turns out to be $39, wou ld be your revised answers?

c. Suppose you had bought a September 22 put with exercise price $42. What would be your answers, if the share price at expiration is $40?

Last price: 40.180 Call Sep 22, 2017 W Sep 22, 2017-W Sep 22, 2017-W Sep 22, 2017 W Sep 22, 2017-W Sep 22, 2017-W Sep 22, 2017-W Sep 22, 2017-W Sep 22, 2017-W Sep 22, 2017-W Sep 22, 2017-W Sep 22, 2017-W Net change-0.040 sid price Sep 29, 2017-W Sep 29, 2017-W 3.65 3.15 2.69 1.22 74 29 0.89 0.54 0.28 0.12 0.04 0.01 3.7 3.2 Sep 29, 2017-W 2.75 Data delayed by at least 15 minutes. Open interest: 20.547 Ask price 3.8 3.3 2.79 2.28 1.8 1.35 0.95 0.59 0.34 0.17 0.1 0.1] 3.8 3.35 2.84 CNQ-Canadian Natural Resources Limited. (Last update: September 14, 2017, at 5:30 p.m.) Bid price: 40.180 Ask price: 40.380 Last price 3.8 3.3 2.79 2.28 1.8 1.35 0.95 0.59 0.34 0.17 0.1 0.11 3.8 3.35 2.84 Figure 2.11 Canadian equity option listings: CNQ Source: Canadian Derivatives Exchange: www.m-.ca/accuclar.php Impiled volatility 51.30% 5140% 52.50% 53.40% 55.30% 59.10% 64.50% 6..20% 55.40% 52.80% 52.60% TH 52.60% 51.20% Strike 36.5 37 37.5 38 38.5 39 39.5 40 40.5 41 41.5 42 36.5 37 37.5 Put Sep 22, 2017 W Sep 22, 2017-W Sep 22, 2017-W Sep 22, 2017.W Sep 22, 2017-W Sep 22, 2017 W Sep 22, 2017-W Sep 22, 2017-W Sep 22, 2017-W Sep 22, 2017-W Sep 22, 2017-W Sep 22, 2017 W Sep 29, 2017 W Sep 29, 2017-W Sep 29, 2017 W 30 Day historical volatility: 19.91% Last price Bid price 0 0 0.01 0.02 0.05 0.09 0.19 0.34 0.59 0.91 1.33 1.79 0.02 0.04 0.06 Ask price 0.11 0.11 0.11 0.11 0.11 0.15 0.23 0.39 0.63 0.97 1.4 1.88 0.1 0.11 0,11 Open interest: 9,047 0.11 0.11 0.11 0.11 0.11 0.15 0.23 0.39 0.63 097 14 188 0.1 0.11 0.11 Implied volatility 51.10% 51.10% 51.80% 52.40% 53.90% 57.30% 63.10% 59.70% 53.70% 50.90% 49.70% *** $1.40% 51.70%

Step by Step Answer:

a Because the stock price exceeds the exercise price you will choose t...View the full answer

Investments

ISBN: 9781259271939

9th Canadian Edition

Authors: Zvi Bodie, Alex Kane, Alan Marcus, Lorne Switzer, Maureen Stapleton, Dana Boyko, Christine Panasian

Related Video

Stocks (also known as equities) are securities that represent ownership in a company. They are issued by companies to raise capital, and when an individual buys stocks, they become a shareholder in that company. Investing in stocks can be a way for individuals to potentially earn a return on their investment through dividends and capital appreciation. However, investing in stocks also carries a level of risk, as the value of the stock can fluctuate based on various factors such as the financial performance of the company and general market conditions. For companies, issuing stocks can be a way to raise funds for growth and expansion. When a company goes public by issuing an initial public offering (IPO), it can raise significant capital by selling ownership stakes to the public. Companies can also issue additional stock offerings to raise additional capital as needed.

Students also viewed these Business questions

-

Turn to Figure 2.8 and find the options for Canadian Natural Resources. Suppose you buy a June call option with exercise price $ 24, and the stock price in June is $ 28. a. Will you exercise your...

-

Suppose a 6-month maturity call option with exercise price $80 currently sells for $10. Consider a portfolio with $6000 invested in three at-the-money call contracts and $4000 in 6-month T-bills to...

-

Suppose you buy a 9 percent coupon, 15-year bond today when it's first issued. If interest rates suddenly rise to 15 percent, what happens to the value of your bond? Why?

-

Two positive charges, each with charge q = 2.5 nC, are placed as shown in the diagram. The distance d 0.42 m. Find the net electric potential at the point x = 0, y = 0.12 m.

-

What are the three most important characteristics of a small business computer accounting system? Why do you think these are the most important?

-

Ammonia has the formula NH 3 , and methane has the formula CH 4 . According to Dalton, which atom has more hooks on it, N or C, and how many more hooks does it have?

-

Compare the mean silhouette values for the two cluster models. Which model is preferred?

-

The management of Ferri Phosphate Industries (FPI) is planning next years capital budget. FPI projects its net income at $7,500, and its dividend payout ratio is 30 percent. The companys earnings and...

-

The most recent financial statements for Retro Machine, Inc., follow. Sales for 2014 are projected to grow by 20 percent. Interest expense will remain constant; the tax rate and the dividend payout...

-

You are given the attached information about Fred pic, comprising summarized P&L accounts, summarized balance sheets and some suggested ratio calculations. You should note that there may be...

-

Turn to Figure 2.7 and find the li sting for Aecon Group. a. What was the closing price for Aecon? b. How many shares could you buy for $5 ,000? c. What would be your annual dividend income from...

-

Go to the Australian Taxation Office website (www.ato.gov.au) and select the Business tab, then select Businesses under the Online Services heading. Next, select Standard Business Reporting and then...

-

Consider an American-style put option written on a stock share that does not pay dividends. The continuously compounded risk-free rate is 3%. The option matures in nine months and its strike is...

-

(25 Points) University Painting is considering investing in a new paint sprayer to allow them to paint more classrooms in less time. The sprayer would have the following cash flow and cost of capital...

-

Use the following information for questions 1 and 2. Caterpillar Financial Services Corp. (a subsidiary of Caterpillar) and Sterling Construction sign a lease agreement dated January 1, 2020, that...

-

Summit Regional Medical Center operates as a private not-for-profit hospital, providing services to a community of 20,000 and the surrounding rural areas. Summit has maintained a banking relationship...

-

Woodland Wearables produces two models of a smart watch, the Basic and the Flash. The watches have the following characteristics: Basic Flash Selling price per watch $ 3 3 0 $ 4 9 0 Variable cost per...

-

Introduction This practice case has been designed to give introductory-level business students practical experience in the application of accounting concepts. This practice case will provide students...

-

Write the numbers in increasing order from left to right. 0, - 3, 3, - 6, 6, - 9

-

The Smiths buy a house. They borrow 80 percent of the purchase price from the local ABC Savings and Loan. Before they make their first payment, ABC transfers the right to receive mortgage payments to...

-

Should you buy a stock with a high? a) Current ratio? b) Return on equity? c) Payout ratio? d) Debt ratio?

-

What does the statement of cash flows add to the analysts knowledge of the firm?

-

Compare the yearly statements of cash flow in Exhibit 13.7 and answer the following questions. (a) Did the firms operations consistently generate cash? (b) Has there been any change in the type of...

-

Physical Units Method, Relative Sales Value Method Farleigh Petroleum, Inc., is a small company that acquires high - grade crude oil from low - volume production wells owned by individuals and small...

-

A proposed $2.5 M investment in new equipment at a 100 MG/y M&Ms factory will save the plant $800,000/y in energy costs. Assuming an annual interest rate of 5%/y (compounded annually), and an...

-

Brief Exercise 10-7 Coronado Company obtained land by issuing 2,250 shares of its $14 par value common stock. The land was recently appraised at $103,240. The common stock is actively traded at $44...

Study smarter with the SolutionInn App