With respect to the capital asset pricing model, if expected return for Security 2 is equal to

Question:

With respect to the capital asset pricing model, if expected return for Security 2 is equal to 11.4% and the risk-free rate is 3%, the expected return for the market is closest to:

A. 8.4%.

B. 9.0%.

C. 10.3%.

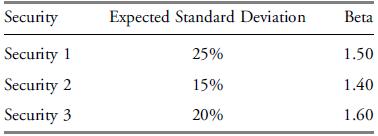

Use the following data to answer question:

An analyst gathers the following information:

Transcribed Image Text:

Security Expected Standard Deviation Beta Security 1 25% 1.50 Security 2 15% 1.40 Security 3 20% 1.60

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 33% (3 reviews)

Answered By

Ali Khawaja

my expertise are as follows: financial accounting : - journal entries - financial statements including balance sheet, profit & loss account, cash flow statement & statement of changes in equity -consolidated statement of financial position. -ratio analysis -depreciation methods -accounting concepts -understanding and application of all international financial reporting standards (ifrs) -international accounting standards (ias) -etc business analysis : -business strategy -strategic choices -business processes -e-business -e-marketing -project management -finance -hrm financial management : -project appraisal -capital budgeting -net present value (npv) -internal rate of return (irr) -net present value(npv) -payback period -strategic position -strategic choices -information technology -project management -finance -human resource management auditing: -internal audit -external audit -substantive procedures -analytic procedures -designing and assessment of internal controls -developing the flow charts & data flow diagrams -audit reports -engagement letter -materiality economics: -micro -macro -game theory -econometric -mathematical application in economics -empirical macroeconomics -international trade -international political economy -monetary theory and policy -public economics ,business law, and all regarding commerce

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Investments Principles Of Portfolio And Equity Analysis

ISBN: 9780470915806

1st Edition

Authors: Michael McMillan, Jerald E. Pinto, Wendy L. Pirie, Gerhard Van De Venter, Lawrence E. Kochard

Question Posted:

Students also viewed these Business questions

-

Identify the types of risks that a company may be exposed to if it operates in a dynamic and fast-paced business environment. Motivate your answer with five reasons why those particular risks will...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

PLEASE GIVE CORRECT ANSWERS Prove that the number of comparators in any sorting network is (n log n). [4 marks] (ii) What does Part (d)(i) imply in terms of the depth of any sorting network? [1 mark]...

-

When we create our own Market Limitations In the mid-1960s a new electronics company was founded with a unique high-tech product a new type of computer. Thanks to its engineering know-how LOCKDOWN...

-

It is not uncommon after a round of golf to find a foursome in the clubhouse shaking the bar dice to see who buys the refreshments. In the first two rounds, each person gets to shake the five dice...

-

construct a consumption biography of a friend or family member. make a list of and/ or photograph their favourite possessions, and see if you or others can describe this persons personality just from...

-

Funhouse mirrors distort your image so that you look shorter, taller, fatter, or thinner than you actually are. For the three images shown in Figure Q24.20, describe the curvature of the mirror....

-

For each of the problems listed, determine the following quantities for each activity: the earliest start time, latest start time, earliest finish time, latest finish time, and slack time. List the...

-

Blue Skles Equipment Company uses the aging approach to estimate bad debt expense at the end of each accounting year. Credit sales occur frequently on terms 1/60. The balance of each account...

-

With respect to the capital asset pricing model, if the expected market risk premium is 6% the security with the highest expected return is: A. Security 1. B. Security 2. C. Security 3. Use the...

-

With respect to the capital asset pricing model, if the expected market risk premium is 6% and the risk-free rate is 3%, the expected return for Security 1 is closest to: A. 9.0%. B. 12.0%. C. 13.5%....

-

Let f(x) = e -2x . For x > 0, let P(x) be the perimeter of the rectangle with vertices (0, 0), (x, 0), (x, f(x)) and (0, f(x)). Which of the following statements is true? (a) The function P has an...

-

Alvarado Company produces a product that requires 5 standard direct labor hours per unit at a standard hourly rate of $12.00 per hour. If 5,700 units used 29,400 hours at an hourly rate of $11.40 per...

-

7. (30 points) You are a teaching assistant (TA) for a new course in the department and you wish to measure the amount of time that students spend engaging with the online resources. Using the Canvas...

-

Mod Clothiers makes women's clothes. It costs $28,000 to produce 5,000 pairs of polka-dot polyester pants. They have been unable to sell the pants at their usual price of $50.00. The company is...

-

In a mid-sized manufacturing company, the annual financial statements were prepared for audit by an external auditing firm. The company\'s finance team had diligently compiled the financial data, and...

-

Explain the meaning of the SMART acronym. In 100-200 words, define what the words "goal" and "success" mean to you. Summarize your thoughts on whether or not the SMART model can help you become a...

-

Explain how a citation search differs from using a citator.

-

Subtract the polynomials. (-x+x-5) - (x-x + 5)

-

Discuss whether there are individual differences in negotiator effectiveness.

-

Discuss whether there are individual differences in negotiator effectiveness. Discuss.

-

Discuss whether there are individual differences in negotiator effectiveness. Discuss in detail.

-

Given that rJ = 6.3%, rRF = 4.1%, and rM = 9.4%, determine the beta coefficient for Stock J that is consistent with equilibrium.

-

Simon Companys year-end balance sheets follow. At December 31 2017 2016 2015 Assets Cash $ 33,019 $ 37,839 $ 38,623 Accounts receivable, net 93,822 65,556 54,152 Merchandise inventory 117,963 89,253...

-

PLEASE REFER TO THE 2018 ANNUAL REPORT OF STARBUKS FOR THE YEAR FISCAL YR 2018, ENDING SEPTEMBER 30, 2018. Refer to the management discussion & analysis section and write a one page summary...

Study smarter with the SolutionInn App