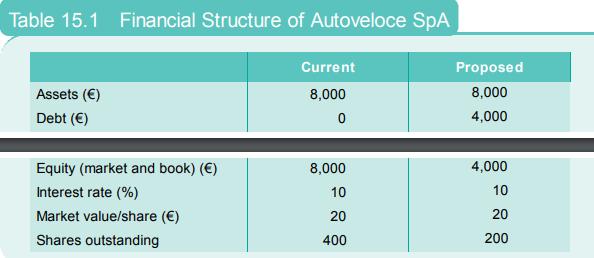

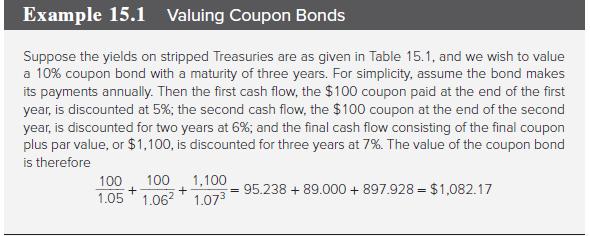

Using the data in Table 15.1, calculate the price and yield to maturity of a 3-year bond

Question:

Using the data in Table 15.1, calculate the price and yield to maturity of a 3-year bond with a coupon rate of 4% making annual coupon payments. Does its yield match that of either the 3-year zero or the 10% coupon bond considered in Example 15.1? Why is the yield spread between the 4% bond and the zero smaller than the yield spread between the 10% bond and the zero?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

ISE Investments

ISBN: 9781260571158

12th International Edition

Authors: Zvi Bodie, Alex Kane, Alan Marcus

Question Posted: