Suppose there are $n$ random variables $x_{1}, x_{2}, ldots, x_{n}$ and let $mathbf{V}$ be the corresponding covariance

Question:

Suppose there are $n$ random variables $x_{1}, x_{2}, \ldots, x_{n}$ and let $\mathbf{V}$ be the corresponding covariance matrix. An eigenvector of $\mathbf{V}$ is a vector $\mathbf{v}=$ $\left(v_{1}, v_{2}, \cdots, v_{n}\right)$ such that $\mathbf{V} \mathbf{v}=\lambda \mathbf{v}$ for some $\lambda$ (called an eigenvalue of $\mathbf{V}$ ). The random variable $v_{1} x_{1}+v_{2} x_{2}+\cdots+v_{n} x_{n}$ is a principal component. The first principal component is the one corresponding to the largest eigenvalue of $\mathbf{V}$, the second to the second largest, and so forth.

A good candidate for the factor in a one-factor model of $n$ asset returns is the first principal component extracted from the $n$ returns themselves; that is, by using the principal eigenvector of the covariance matrix of the returns. Find the first principal component forthe data of Example 8.2. Does this factor (when normalized) resemble the return on the market portfolio?

Data from Example 8.2

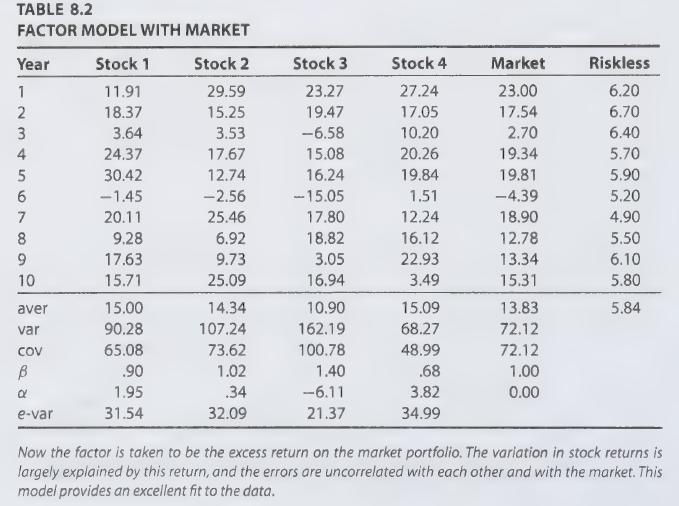

Let us rework by using the excess market return as a factor. We assume that the market consists of just the four stocks, with equal weights. Therefore the market return in any year is just the average of the returns of the four stocks. These are shown in the upper portion of Table 8.2. We also adjoin the historical value of the risk-free rate of return for each of the 10 years. The relevant statistical quantities are computed by the same estimating formulas as in the earlier example, except that the factor is taken to be the excess return on the market, which will change the formula for αi to αi. As seen from the table, a large portion of the variability of the stock returns is explained by the factor. In other words, there is relatively low nonsystematic risk. Furthermore, a side calculation shows that the errors are close to being uncorrelated with each other and with the market return. For example, the data provide the estimates cov (e1,e2) = –14 and cov (e2,e3) = 2, which are much smaller than for the earlier model. We conclude that this single-factor model is an excellent representation of the stock returns of the four stocks. In other words, for this example, the market return serves as a much better factor than the industrial index factor used earlier. However, this may not be true for other examples.

Step by Step Answer: