a. Assume that you can buy U.S. Coal for $20 per share, either paying cash or buying

Question:

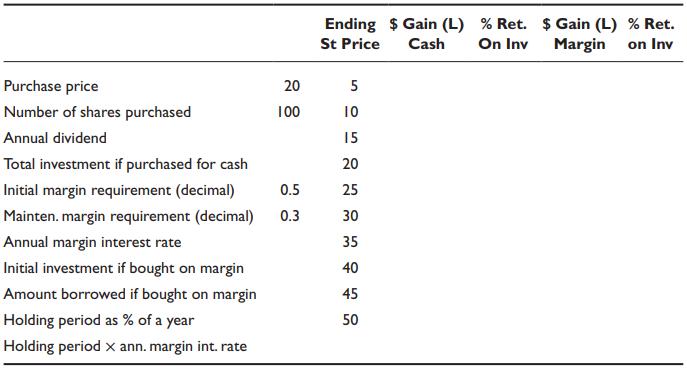

a. Assume that you can buy U.S. Coal for $20 per share, either paying cash or buying on margin. The initial margin requirement is 50 percent, and the maintenance margin is 30 percent. U.S. Coal pays $0.25 per share in annual dividends. The margin interest cost is 6 percent. Using the spreadsheet format illustrated, calculate the $ gain or loss on both a cash basis and on a margin basis for 100 shares assuming possible ending prices for the stock as illustrated. The projected holding period is six months. Also calculate the percentage gain or loss on the initial investment for both a cash basis and a margin basis. Note that the holding period is expressed as part of a year in decimal form (e.g., three months = 0.25). Dividends are assumed to be paid quarterly. Thus, if the holding period is three months and the annual dividend is $40, the dividend for the holding period is $10. Ignore tax considerations.

b. If you buy 500 shares instead of 100 shares, with all other parameters the same, would the percentage return on investment change?

Step by Step Answer:

Investments Analysis And Management

ISBN: 9781118975589

13th Edition

Authors: Charles P. Jones, Gerald R. Jensen