Assume that an investor purchased 100 shares of HewlettPackard last year for $40 per share and this

Question:

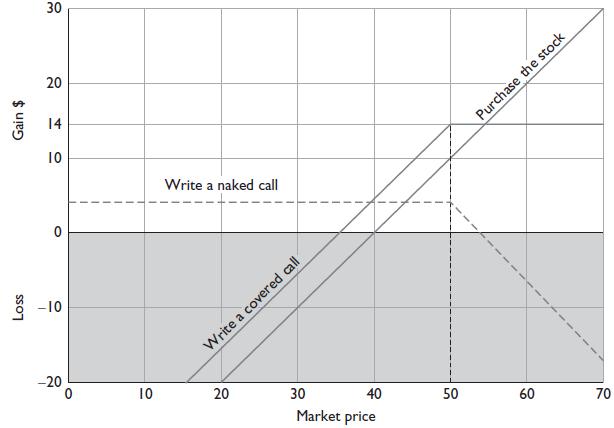

Assume that an investor purchased 100 shares of Hewlett‐Packard last year for $40 per share and this year, with the stock price at $48, writes a (covered) six‐month call with an exercise price of $50. The writer receives a premium of $4. This situation is illustrated in Figure 19‐7.

If called on to deliver the shares, the investor receives $50 per share, plus the $4 premium, for a gross profit of $14 per share (since the stock was purchased at $40 per share). However, the investor gives up the additional potential gain if the stock price rises above $50—shown by the flat line to the right of $50 for the covered call position in Figure 19‐7. If the price rises to $60, for example, the investor grosses $14 per share but could have grossed $20 per share if no call had been written.

Writing a naked call is also illustrated (by the broken line) in Figure 19‐7. If the call is not exercised, the writer profits by the amount of the premium, $4. The naked writer’s breakeven point is $54. This position will be profitable if the price of the stock does not rise above the breakeven point. The potential gain for the naked writer is limited to $4, whereas the potential loss is large. If the stock price rises sharply, the writer could easily lose an amount in excess of what was received in premium income.

Figure 19‐7

Step by Step Answer:

Investments Analysis And Management

ISBN: 9781118975589

13th Edition

Authors: Charles P. Jones, Gerald R. Jensen