A You are employed by Monarch Ltd which manufactures specialist hydraulic seals for the aircraft industry. The

Question:

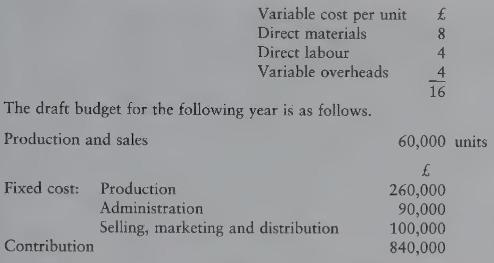

A You are employed by Monarch Ltd which manufactures specialist hydraulic seals for the aircraft industry. The company has developed a new seal with the following budgeted data.

Certain departmental managers within the company believe there is room for improvement on the budgeted figures, and the following options have been suggested.

(i) The sales manager has suggested that if the selling price was reduced by 10 per cent, then an extra 30 per cent units could be sold. The purchasing manager has indicated that if material requirements were increased in line, then a material price reduction of 6.25 per cent could be negotiated. With this additional output, fixed production costs would increase by \(£ 30,000\), administration by \(£ 5,000\) and selling, marketing and distribution by \(£ 10,000\). Other costs would remain unchanged.

(ii) The export manager has suggested that if the company increased overseas marketing by \(£ 15,000\) then exports would increase from 15,000 units to 17,000 units. With this suggestion, distribution costs would increase by \(£ 12,000\), and all other costs would remain unchanged.

(iii) The marketing manager has suggested that if an extra \(£ 40,000\) were spent on advertising, then sales quantity would increase by 25 per cent. The purchasing manager has indicated that in such circumstances, material costs would reduce by \(£ 0.30\) per unit. With this suggestion fixed production costs would increase by \(£ 25,000\), administration by \(£ 4,000\) and other selling, marketing and distribution costs by \(£ 7,000\). All other costs would remain unchanged.

(iv) The managing director believes the company should be aiming for a profit of \(£ 486,000\). He asks what the selling price would be per unit if marketing were increased by \(£ 50,000\), this leading to an estimated increase in sales quantity of 30 per cent? Other fixed costs would increase by \(£ 67,000\), whilst material prices would decrease by 6.25 per cent per unit. All other costs would remain unchanged.

\section*{Required:}

A Taking each suggestion independently, compile a profit statement for options (i) to (iii), showing clearly the contribution per unit in each case. For suggestion (iv), calculate the selling price per unit as requested by the managing director.

B Calculate the break-even quantity in units if the Managing Director's suggestion were implemented. Draw a contribution/sales graph to illustrate your calculations.

Read from the graph the profit if 60,000 units were sold.

C Whilst marginal costing has a number of applications, it also has disadvantages. In a report to the managing director, outline the main applications of marginal costing and explain its disadvantages.

Step by Step Answer: