Drake Ltd's cost and revenues for the current year are expected to be: It was expected that

Question:

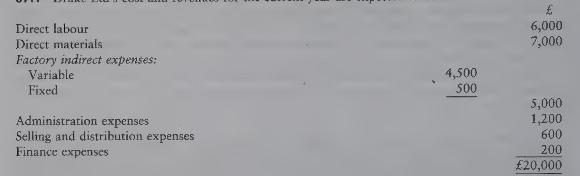

Drake Ltd's cost and revenues for the current year are expected to be:

It was expected that 2,000 units would be manufactured and sold, the selling price being \(£ 11\) each.

Suddenly during the year two enquiries were made at the same time which would result in extra production being necessary. They were:

(A) An existing customer said that he would take an extra 100 units, but the price would have to be reduced to \(£ 9\) per unit on this extra 100 units. The only extra costs that would be involved would he in respect of variable costs.

(B) A new customer would take 150 units annually. This would mean extra variable costs and also an extra machine would have to be bought costing \(£ 1,500\) which would last for 5 years before being scrapped. It would have no scrap value. Extra running costs of this machine would be \(£ 600\) per annum. The units are needed for an underdeveloped country and owing to currency difficulties the highest price that could be paid for the units was \(£ 10\) per unit.

On this information, and assuming that there are no alternatives open to Drake Ltd, should the company accept or reject these orders? Draft the memo that you would give to the managing director of Drake Ltd.

Step by Step Answer: