RJ commenced business on 1 January (19 mathrm{X} 8). He sells refrigerators, all of one standard type,

Question:

RJ commenced business on 1 January \(19 \mathrm{X} 8\). He sells refrigerators, all of one standard type, on hire purchase terms. The total amount, including interest, payable for each refrigerator, is \(£ 300\). Customers are required to pay an initial deposit of \(£ 60\), followed by eight quarterly instalments of \(£ 30\) each. The cost of each refrigerator to \(\mathrm{RJ}\) is \(£ 200\).

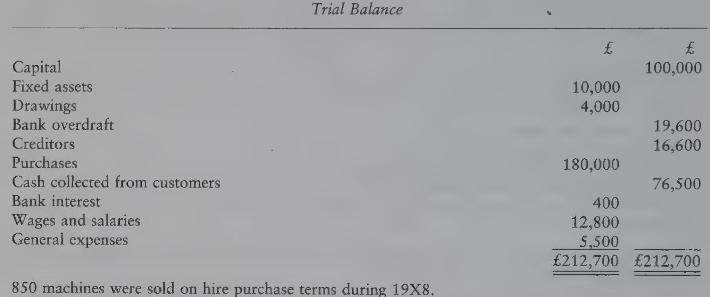

The following trial balance was extracted from RJ's books as on 31 December 19X8.

The annual accounts are prepared on the basis of taking credit for profit (including interest) in proportion to the cash collected from customers.

You are required to prepare the hire purchase trading account, and the profit and loss account for the year \(19 \mathrm{X} 8\) and balance sheet as on 31 December \(19 \mathrm{X} 8\).

Ignore depreciation of fixed assets.

Show your calculations.

Step by Step Answer: