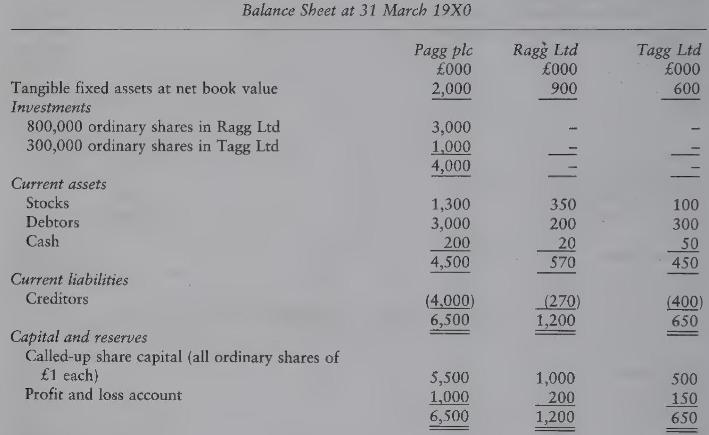

The following summarised information relates to the Pagg group of companies. section*{Additional information:} 1 Pagg acquired its

Question:

The following summarised information relates to the Pagg group of companies.

\section*{Additional information:}

1 Pagg acquired its shareholding in Ragg Ltd on 1 April 19X5. Ragg's profit and loss account balance at that time was \(£ 600,000\).

2 The shares in Tagg Ltd were acquired on 1 April 19X9 when Tagg's profit and loss account balance was \(£ 100,000\).

3 All goodwill arising on consolidation is amortised in equal amounts over a period of 20 years commencing from the date of acquisition of each subsidiary company.

4 At 31 March 19X0, Ragg had in stock goods purchased from Tagg at a cost to Ragg of \(£ 60,000\). These goods had been invoiced by Tagg at cost plus 20 per cent. Minority interests are not charged with any inter-company profit.

5 Inter-company debts at 31 March 19X0 were as follows:

Pagg owed Ragg \(£ 200,000\) and Ragg owed Tagg \(£ 35,000\).

\section*{Required:}

Insofar as the information permits, prepare the Pagg group of companies' consolidated balance sheet as at 31 March 19X0 in accordance with the Companies Acts and standard accounting practice. Note: Formal notes to the accounts are NOT required, although detailed working must be submitted with your answer.

Step by Step Answer: