Nominal and real interest rates around the world a. There are a few episodes of negative nominal

Question:

Nominal and real interest rates around the world

a. There are a few episodes of negative nominal interest rates around the world. Some may or may not be in play as you read this book. The Swiss nominal policy rate, the Swiss equivalent of the federal funds rate is series IRSTCI01CHM156N from the FRED database maintained at the Federal Reserve Bank of St. Louis. The Swiss nominal policy rate was negative in 2014 and 2015 . If so, why not hold cash instead of bonds? In the United States, the Federal Reserve has not (yet) set the nominal policy rate below zero.

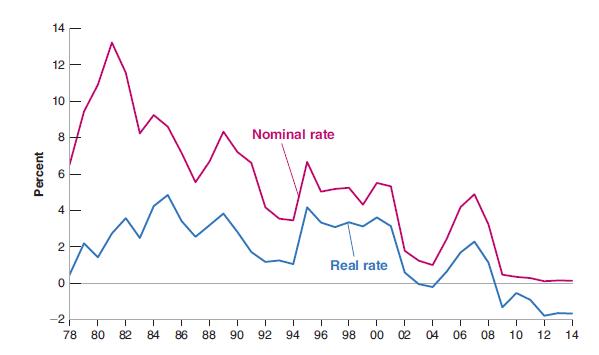

b. The real rate of interest is frequently negative, see Figure 6-2. Under what circumstances can it be negative? If so, why not just hold cash instead of bonds?

Figure 6-2

c. What are the effects of a negative real interest rate on borrowing and lending?

d. Find a recent issue of The Economist and look at the table in the back (titled "Economic and financial indicators"). Use the three-month money market rate as a proxy for the nominal policy interest rate, and the most recent three month rate of change in consumer prices as a measure of the expected rate of inflation (both are expressed in annual terms). Which countries have the lowest nominal interest rates? Do any countries have a negative nominal policy rate? Which countries have the lowest real interest rates? Are some of these real interest rates negative?

Step by Step Answer: