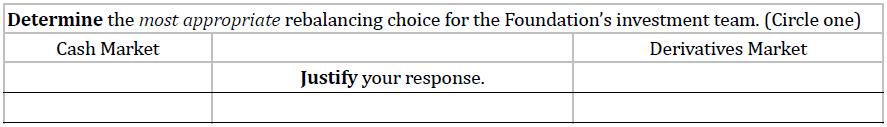

Determine the most appropriate rebalancing choice for the Foundations investment team. Justify your response. The Lemont Family

Question:

Determine the most appropriate rebalancing choice for the Foundation’s investment team. Justify your response.

The Lemont Family Foundation follows a systematic quarterly rebalancing policy based on rebalancing corridors for each asset class. In the latest quarter, a significant sell-off in US public equities resulted in an unusually large 1.2% underweight position relative to the applicable lower corridor boundary. This is the only policy exception requiring rebalancing attention.

The Foundation’s investment team views the sell-off as temporary and remains pleased with the performance of all external managers, including that of its US public equities manager. However, the selloff has increased the significance of liquidity and flexibility for the team. As a result, the team now considers whether to rebalance through the cash market or the derivatives market.

Step by Step Answer: