Which asset class would best satisfy the Funds diversification strategy? A. Private equity B. Private real estate

Question:

Which asset class would best satisfy the Fund’s diversification strategy?

A. Private equity B. Private real estate C. Absolute return hedge fund Eileen Gension is a portfolio manager for Zen-Alt Investment Consultants (Zen-Alt), which assists institutional investors with investing in alternative investments. Charles Smittand is an analyst at Zen-

Alt and reports to Gension. Gension and Smittand discuss a new client, the Benziger University Endowment Fund (the fund), as well as a prospective client, the Opeptaja Pension Plan (the plan).

The fund’s current portfolio is invested primarily in public equities, with the remainder invested in fixed income. The fund’s investment objective is to support a 6% annual spending rate and to preserve the purchasing power of the asset base over a 10-year time horizon. The fund also wants to invest in assets that provide the highest amount of diversification against its dominant equity risk. Gension considers potential alternative investment options that would best meet the fund’s diversification strategy.

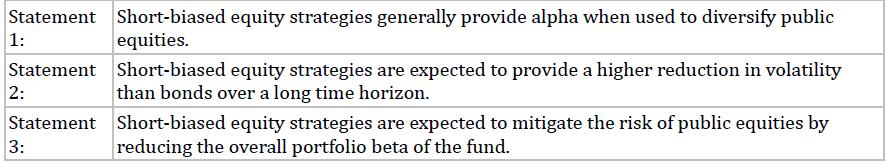

In preparation for the first meeting between Zen-Alt and the fund, Gension and Smittand discuss implementing a short-biased equity strategy within the fund. Smittand makes the following three statements regarding short-biased equity strategies:

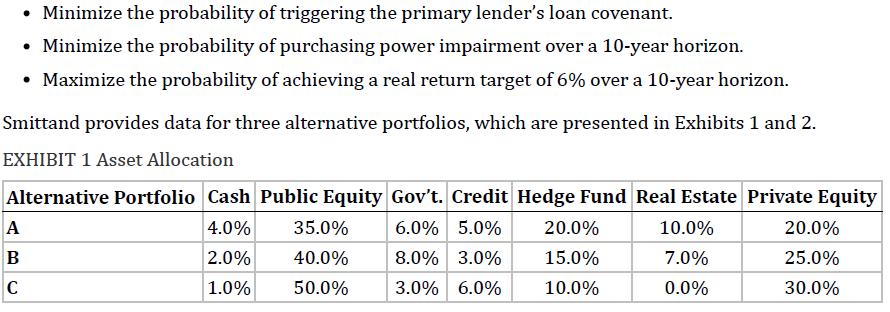

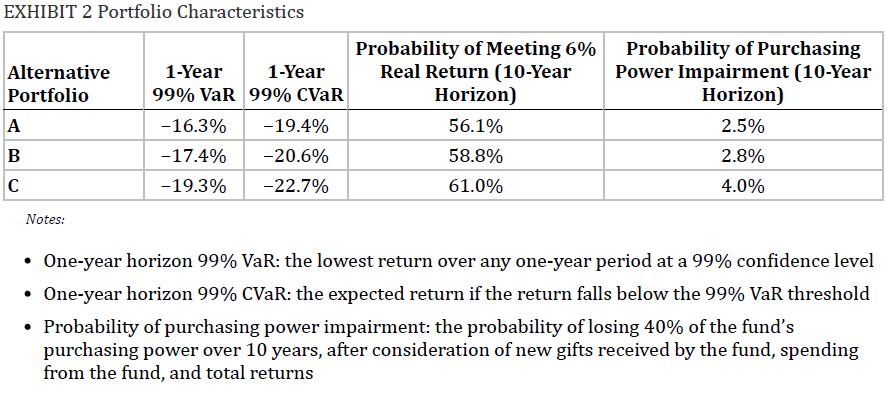

Gension directs Smittand to prepare asset allocation and portfolio characteristics data on three alternative portfolios. The fund’s risk profile is one factor that potential lenders consider when assigning a risk rating to the university. A loan covenant with the university’s primary lender states that a re-evaluation of the university’s creditworthiness is triggered if the fund incurs a loss greater than 20% over any one-year period. Smittand states that the recommended asset allocation should achieve the following three goals, in order of priority and importance:

Gension next meets with the investment committee (IC) of the Opeptaja Pension Plan to discuss new opportunities in alternative investments. The plan is a $1 billion public pension fund that is required to provide detailed reports to the public and operates under specific government guidelines. The plan’s IC adopted a formal investment policy that specifies an investment horizon of 20 years. The plan has a team of in-house analysts with significant experience in alternative investments.

During the meeting, the IC indicates that it is interested in investing in private real estate. Gension recommends a real estate investment managed by an experienced team with a proven track record.

The investment will require multiple capital calls over the next few years. The IC proceeds to commit to the new real estate investment and seeks advice on liquidity planning related to the future capital calls.

Step by Step Answer: