Musical Productions Ltd, a client of your firm, has two divisions. The Compact Disc division (CD) assembles

Question:

Musical Productions Ltd, a client of your firm, has two divisions. The Compact Disc division (‘CD’) assembles and markets portable compact disc players. The Portable Stereo division (‘PS’) assembles and markets portable tape players.

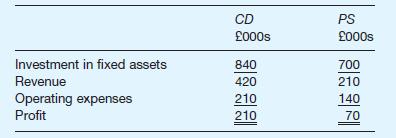

Budgets for the coming year have been prepared by the managers of each division and agreed by the head office, as follows:

A new investment opportunity has arisen. It could be adopted by either division. The initial investment in fixed assets will be £140,000 and the expected annual operating profits from this investment are £28,000.

Musical Productions Ltd presently uses Return on Investment (ROI) as a criterion for evaluating divisional performance, but the finance director is aware that a close competitor applies the Residual Income (RI) method, using a required rate of return of 18% per annum.

Required

Write a report to the finance director explaining:

(a) the relative merits and limitations of ROI, as compared with RI, as a criterion for evaluation of divisional performance; and

(b) the acceptability of the new investment opportunity from the viewpoint of each divisional manager and of Musical Productions Ltd as an entity, using both ROI and RI methods.

Step by Step Answer: