A manufacturing business makes a product in two models, model M1 and model M2. Details of the

Question:

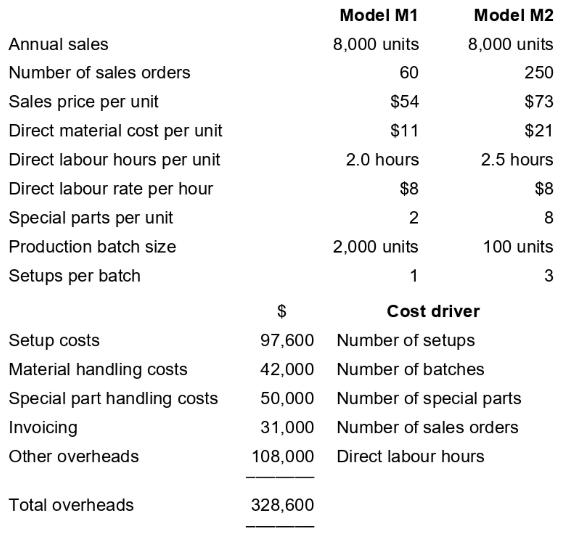

A manufacturing business makes a product in two models, model M1 and model M2. Details of the two products are as follows.

A customer has indicated an interest in placing an order for either model M1 or M2, and the sales manager wished to try to sell the higher-priced model M2.

Required:

(a) Calculate the profit per unit for each model, using $A B C$.

(b) Using the information above identify which product the sales manager should try to sell on the basis of the information provided by your $A B C$ analysis.

1. Purchase order-related costs (including costs of receiving materials and paying suppliers) of $\$ 685,000$ relate to a group of units of product, and are batch-level costs. Batch-level costs are incurred every time batch-level activities (a purchase order being placed, say) is performed. The cost of purchase orders varies with the number of purchase orders, but is common (or fixed) for all purchase orders within a batch.

2. Cost of indirect materials of $\$ 180,000$ changes with labour hours, which are unit-level costs. Therefore, fasteners and fittings costs are unit-level costs.

3. Setup costs of $\$ 450,000$ are batch-level costs because they relate to a group of throwers produced after the machines are set up.

4. Costs of designing processes, drawing process charts, and making engineering changes for individual throwers, $\$ 315,000$, are product sustaining because they relate to the costs of activities undertaken to support individual throwers regardless of the number of units or batches in which the thrower is produced.

5. Factory management, factory rent, and insurance costs of $\$ 578,000$ are facility-sustaining costs because the costs of these activities cannot be traced to individual products, but support the company as a whole.

Step by Step Answer: