A restaurant operator wishes to choose between two alternative roll-in storage units. Machine A will cost $9,000

Question:

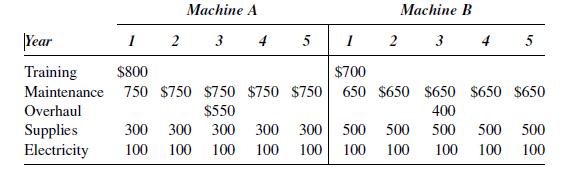

A restaurant operator wishes to choose between two alternative roll-in storage units. Machine A will cost $9,000 and have a trade-in value at the end of its five-year life of $1,500. Machine B will cost $8,500 and at the end of its five-year life will have a trade-in value of $700. Assume straight-line depreciation.

Investment in the machine will mean that a part-time kitchen worker will not be required, and there will be an annual wage saving of $9,600.

The following will be the operating costs, excluding depreciation, for each machine, for each of the five years.

Income tax rate is 30 percent. For each machine, calculate the NPV by using a 12 percent rate. Ignoring any other considerations, which machine would be the preferable investment?

Step by Step Answer:

Hospitality Management Accounting

ISBN: 9780471092223

8th Edition

Authors: Martin G Jagels, Michael M Coltman